Max Bibeau, Preston Sledge

How can we make SOTM better for you?

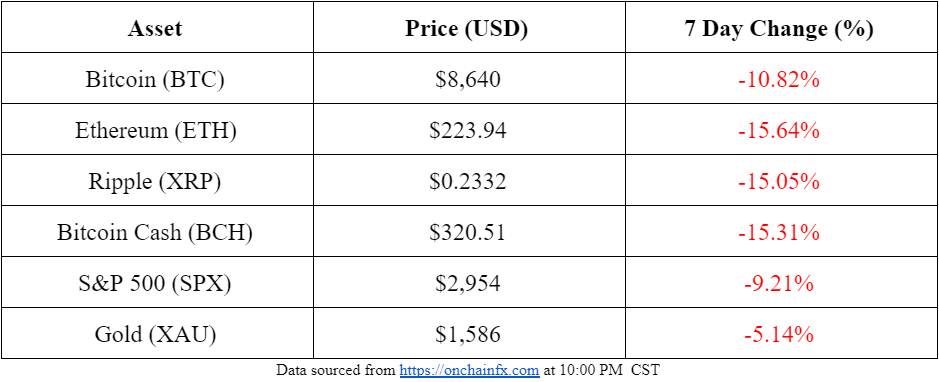

Market Summary

Financial markets as a whole were hit hard this week, as the S&P 500 saw its biggest losses since the 2008 financial crisis. Bitcoin and other cryptocurrencies saw steady losses as well, with many attributing the trend to growing concerns about the coronavirus’ disruption of international commerce and economies.

Top Stories

Stocks Suffer Worst Week Since Financial Crisis Amid Coronavirus Fears

This week demonstrated that financial markets are not immune from the constant headlines regarding the expansion of the coronavirus, a new respiratory infection originating in China. The S&P 500 fell around 11.5% this week, largely due to coronavirus fears. This represents the largest week long fall in the S&P 500 since 2008.

Coinbase tested facial recognition software developed by controversial startup Clearview AI

Clearview AI is a startup company that works primarily with US law enforcement to aggregate massive stores of publicly available images sourced from Twitter, Facebook, Google, and more. They use this data to identify individuals using face recognition technology with the goals of stopping crime ranging from fraud to terrorism. The startup has encountered significant controversy, and is currently engaged in legal battles with the social media giants who have ordered the company to cease and desist. Coinbase has tested utilizing the technology due to the “unique security concerns” surrounding cryptocurrency fraud and crime.

Bitcoin can be used as security: NSW court

In hearing a defamation claim, Judge Judith Gibson of the NSW court in Australia declared that cryptocurrency could be used as a security despite being “a highly unstable investment.” The judge stated that while cryptocurrency would be accepted, the plaintiff would be required to alert the solicitor if the value of the cryptocurrency dipped below the originally demanded amount.

How Artificial Intelligence is Transforming Crypto Industry

In an interesting analysis of AI and its relation to cryptocurrency, CoinSpeaker concluded that AI could “[enhance] control and facilitation to the fast execution of features associated with transforming cryptocurrency for good,” citing AI’s ability to intelligently and independently allocate energy and resources within mining operations, along with it’s potential use in addressing scalability problems through “pruning,” or deleting burdening and unnecessary stored on Bitcoin’s blockchain.

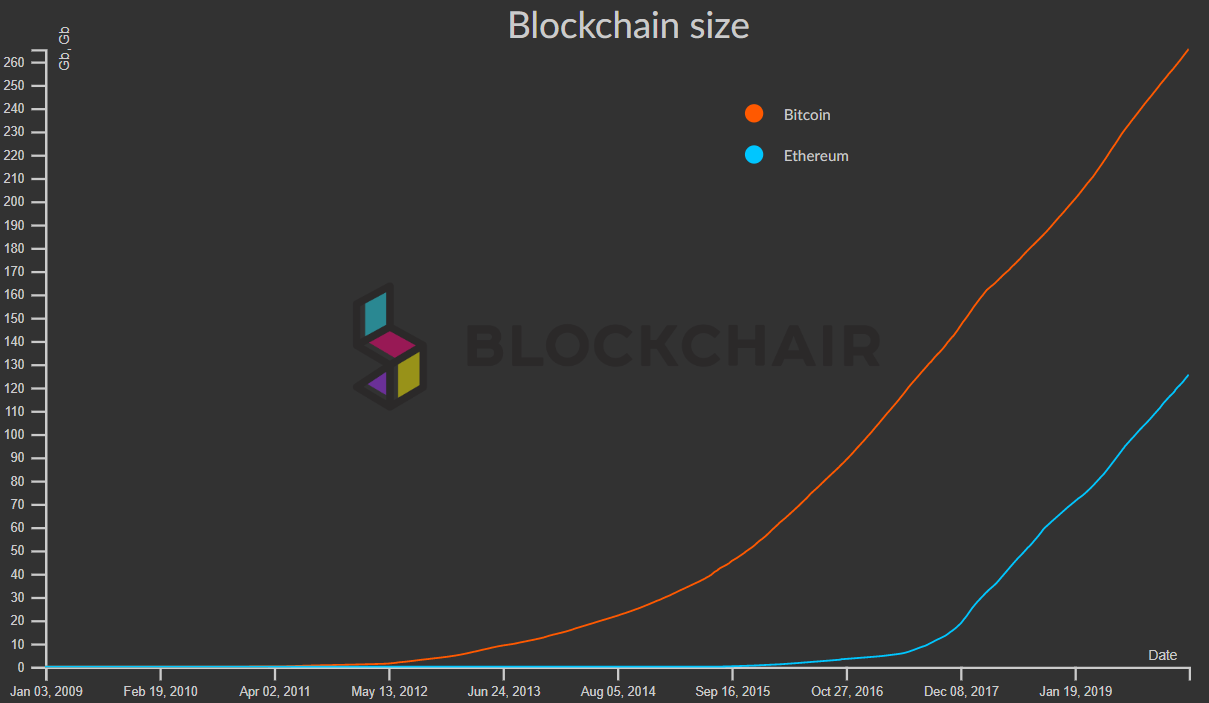

Chart of the Week

The sizes of the Bitcoin and Ethereum blockchains (in GB) ‒ in honor of Bitcoin’s blockchain growing to over 300 GB this week. Ethereum has grown quickly since its launch in 2015. A large blockchain limits the amount of users that can join the network by running a node. This barrier to entry can centralize the validation process.

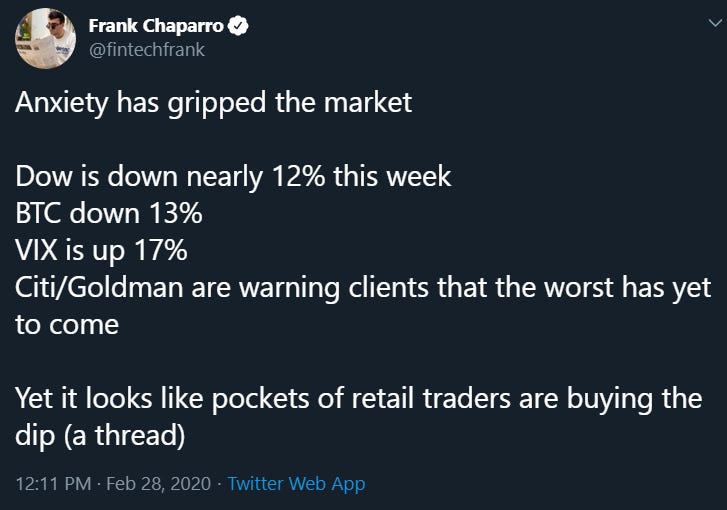

Tweet of the Week

Great thread on the current State of the Market.

When Robinhood enables retail traders.

@allenf32 explores value creation over time by pricing markets in gold.

“Boys… it’s time. I’ll see you on the island.”

@CharlieShrem denounces @ricburton for encouraging fintech startups to ignore legal restrictions. Charlie Shrem knows firsthand what happens when you challenge the law. In 2014, Shrem was sentenced to 2 years in prison for operating the bitcoin exchange BitInstant and selling bitcoin to users of the darknet exchange Silk Road.

Naval Ravikant is the CEO and co-founder of AngelList. See @naval on Joe Rogan here.

Bloomberg (@crypto) claims that Bitcoin is doomed if it doesn’t employ a low and steady inflation rate. The article uses “hoarding” rhetoric to attack saving. They want you to sell.

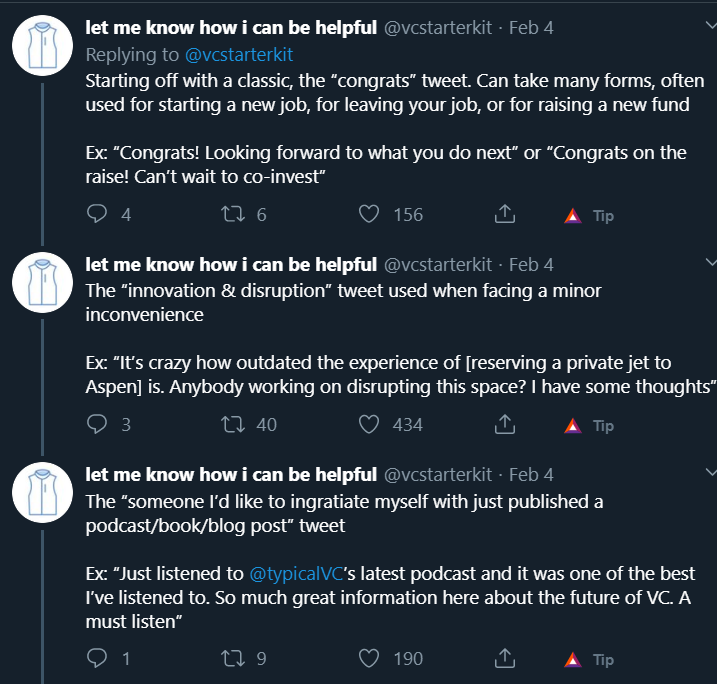

@vcstarterkit dissects typical VC tweets.

@denverbitcoin shares a clip of the new Simpsons episode, which features a nod to cryptocurrency.

Video of the Week

Richard Werner explains how fiat money is created.

Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.