Max Bibeau, Preston Sledge, Matthew Kimmell

Pro-tip: Click on the underlined words for sources, threads, and other fun links. Twitter “threads” are longform tweets where a user responds to themselves repeatedly.

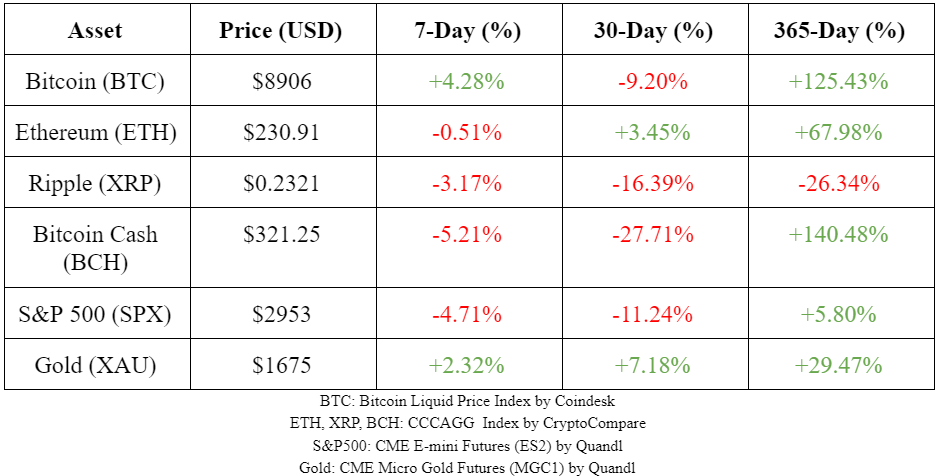

Market Summary

This week demonstrated another difficult week for the S&P 500, as coronavirus fears continue to build, with over 160 cases now being reported in the US according to the CDC. Bitcoin, however, defied the trend of both traditional financial markets and the cryptocurrency market this week, rising about 4% while most other cryptocurrencies took substantial dips.

Top Stories

India & South Korea Legalize Crypto Trading

While you’re dialing back your clocks this Sunday, India and South Korea are dialing back their regulation. India’s Supreme Court overturned a two-year-old ban that barred banks and other financial institutions from facilitating “any service in relation to virtual currencies.” Additionally, the South Korean government passed an amendment enacting official entry of cryptocurrency trading and holding into its legal system. The specifics of how virtual currencies will be regulated in each country can be further explored in the links above.

*Kaff, Kaff* I think I’ve got the Coronavirus pop

Zoolander jokes aside, the coronavirus pandemic is the root of crypto gatherings being shut down all around the globe. Blockchain Week 2020 and TOKEN2049 in Hong Kong, NiTROn Summit in Seoul, Binance Blockchain Week in Vietnam, Bitcoin 2020 in San Francisco, and even our beloved SXSW here in Austin, TX have been postponed or canceled due to the COVID-19 virus.

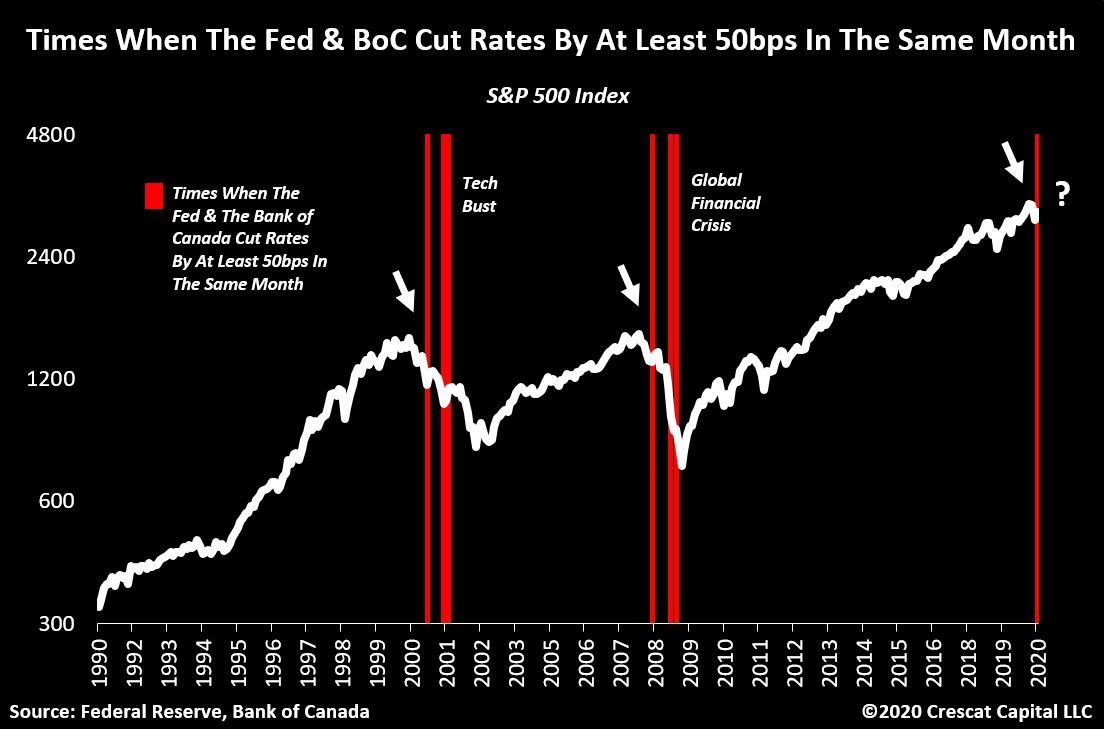

But that’s not all! The Fed cut interest rates by 50 basis points to a target range between 1% and 1.25%, because the coronavirus “poses evolving risks to economic activity.” Whether coronavirus is truly causing the rate cut is unclear, but notably, the emergency cut was the first shift of rates outside of a scheduled policy-setting meeting since October 8th, 2008 -- following the collapse of the Lehman Brothers.

NY Power Plant goes Bitcoin

Greenidge Generations, a natural gas plant near Dresden, NY, has begun mining up to 5.5 BTC per day. In the past four months, the plant has successfully installed a mining farm in its facilities as part of a $65 million renovation project. The plant utilizes its own “behind the meter” power to generate electricity, reportedly consuming 14 of the plant’s 106-megawatt capacity -- enough to supply over 11,000 average US homes with electricity.

Chart of the Week

Last time the Federal Reserve cut interest rates by 50bps was during the Dot Com Boom of 2001 and the Financial Crisis of 2008. Ladies and gentlemen, say hello to the Everything Bubble.

Tweet of the Week

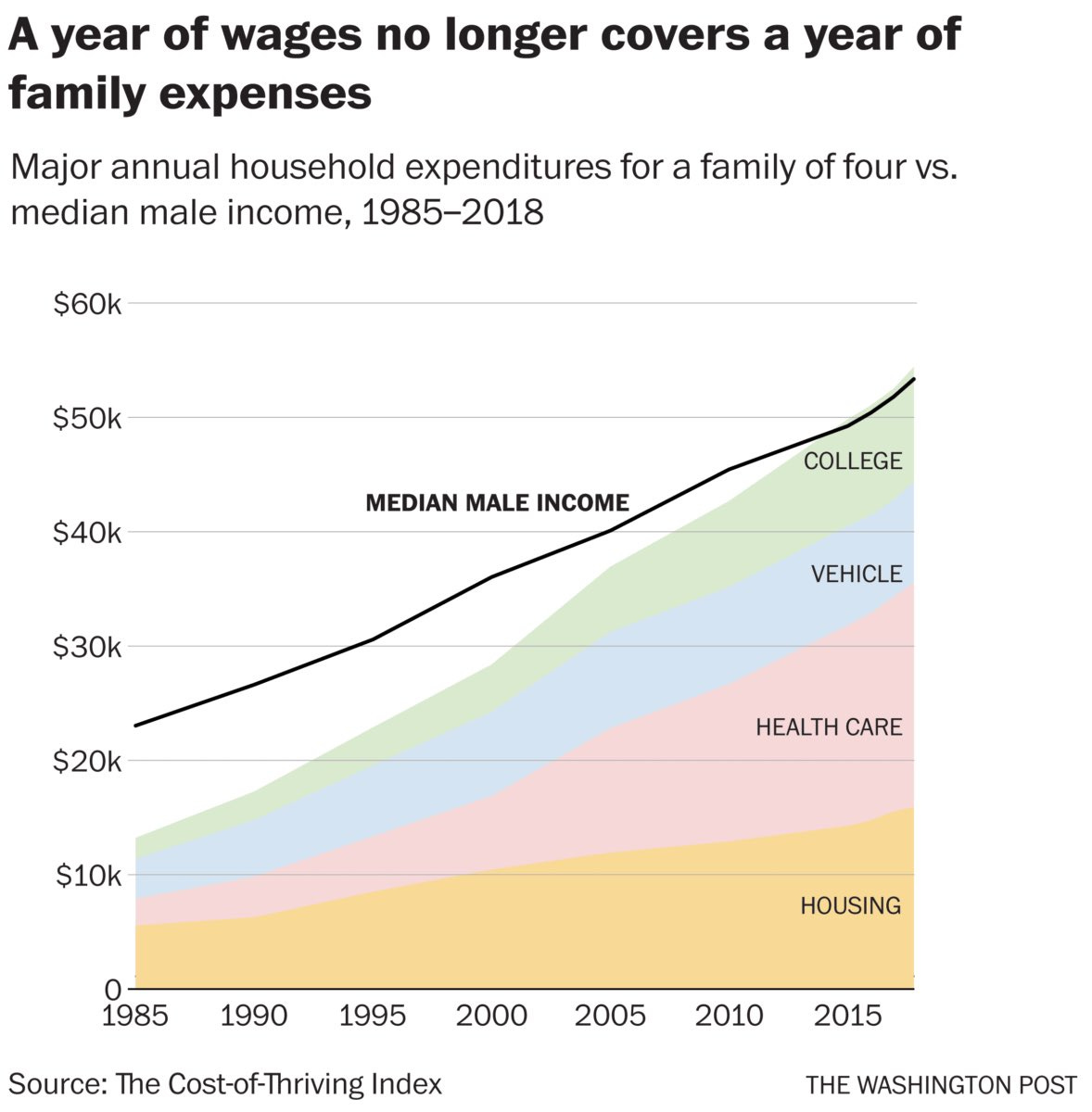

A close runner-up to Chart of the Week, @bpmehlman tweeted this chart, describing it as an “amazing look at why most Americans feel stressed despite ‘record’ prosperity.”

@pierre_rochard is bullish on Bitcoin since its monetary policy is enforced by “a mob of plebs on the internet.” As long as a majority of these plebs remain honest, Bitcoin remains scarce.

Related. A thread by @dhruvbansal, CSO of Unchained Capital. In Bitcoin, plebs (nodes) can easily tell when other plebs are being dishonest.

Left vs. right is a good distraction though.

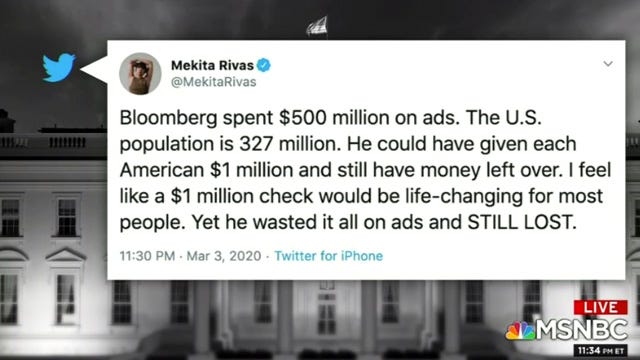

@CryptoWendyO shares a clip from MSNBC where the anchors emphasize a tweet by @MekitaRivas claiming that (Mini) Mike Bloomberg could’ve given each American $1M with all he spent on political ads. A board member at the NYT expressed, “It’s an incredible way of putting it. It’s true. It’s disturbing.” In reality however, $500M / 327M = $1.53 per person. It’s not true at all. And that’s disturbing.

@Trapouts and @djxdomo trade woes about third parties like PayPal and Coinbase censoring their money. Always remember: Not your keys, not your coins.

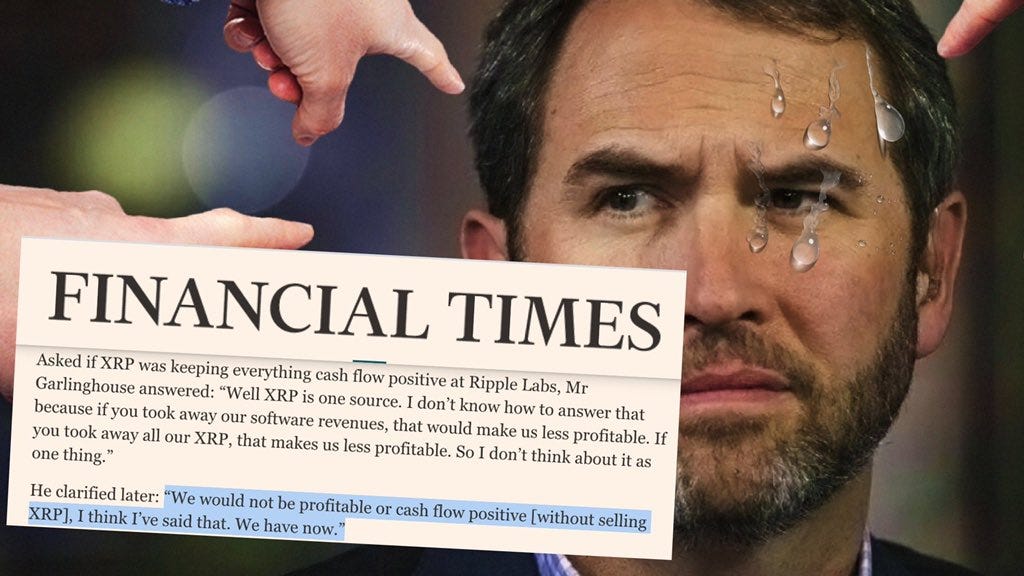

This week, Brad Garlinghouse (CEO of Ripple) admitted that Ripple would not be profitable without selling XRP tokens to investors. This statement portrays XRP as a financial security offered by Ripple the software company, which would make it subject to regulation by the SEC.

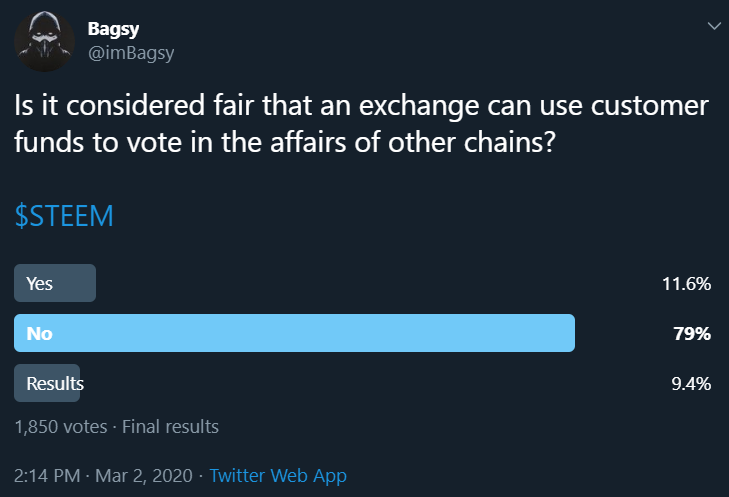

@DavidVorick, lead developer at Sia, summarizes Tron’s (TRX) takeover of the Steem (STEEM) blockchain. Led by Justin Sun, Tron bought Steemit, a private company developing the Steem ecosystem. Steemit owns a large amount of STEEM tokens, but vowed to never use these tokens to participate in Steem’s governance process (based on proof-of-stake). This allowed users to govern the Steem blockchain. However, as Justin Sun began to activate Steemit’s dormant tokens, users initiated a fork to stop the conquest. In response, Justin Sun convinced exchanges like Binance, Huobi, and Poloniex to stake all STEEM tokens in their custody and reject the fork proposed by users.

@imBagsy runs a poll asking if exchanges should be able to use customer funds to participate in the governance of proof-of-stake (PoS) cryptocurrencies. What about staking services offered by exchanges like Coinbase and Kraken? Besides sharing the staking rewards with customers, should these custodians also facilitate customers’ governance preferences? More generally, how can users mitigate the centralization of token supply with large custodians?

@CryptoCharles__ pays his respects to the innovative founders of cryptocurrencies.

SONOFABITCH.

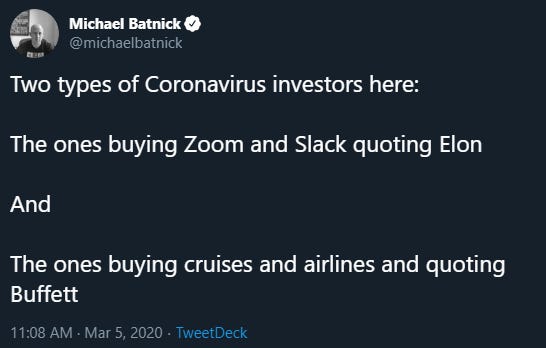

Doomers vs. Boomers

Real Doomers invest in bullets and seeds.

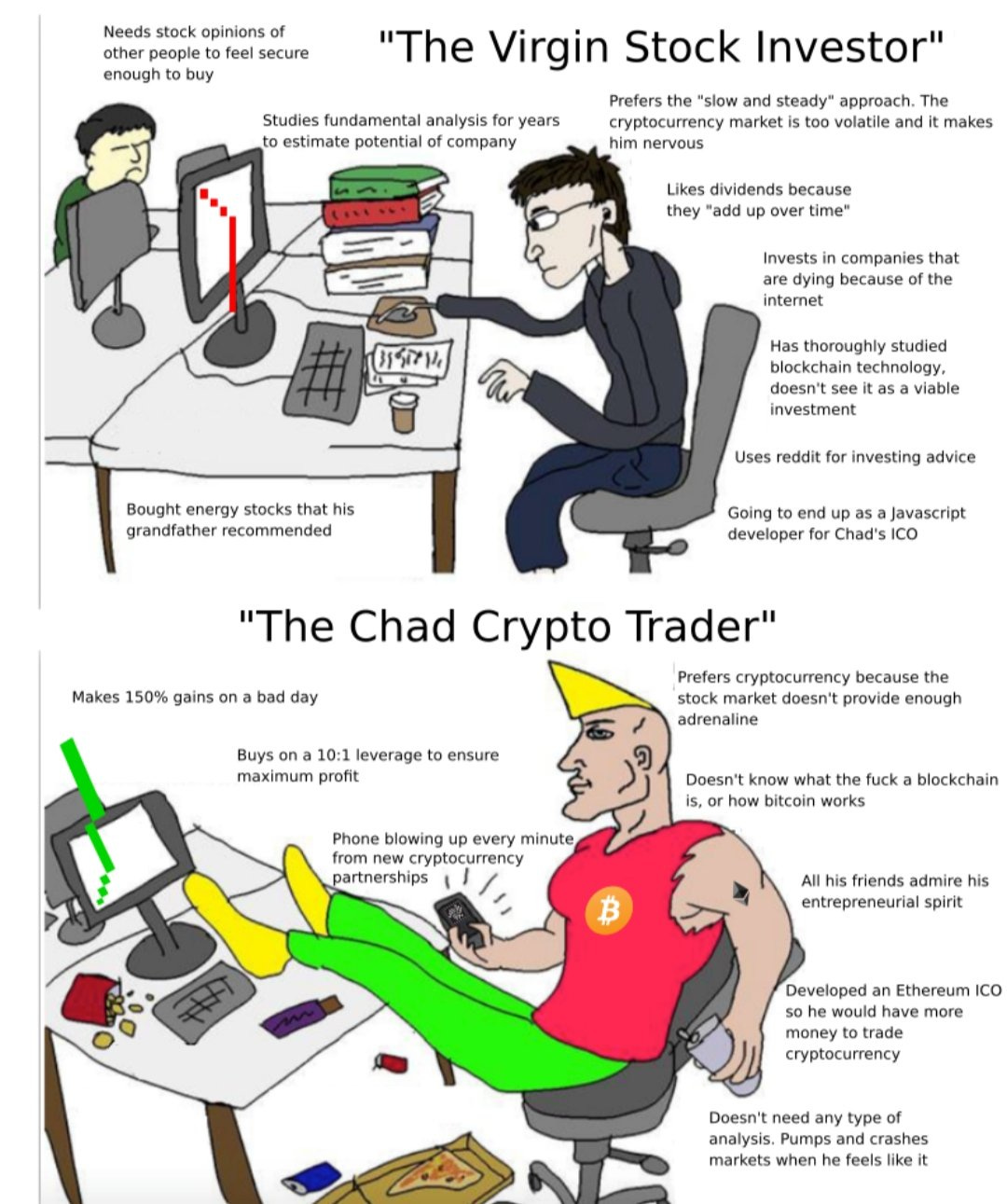

@CryptoBroChad dunks on @RampCapitalLLC, a popular FinTwit (Financial Twitter) influencer, for bashing crypto as an investment thesis.

Ok, maybe we are cryptonerds. From @nixcraft.

Video of the Week

“What We Really Want” with Noam Chomsky. Chomsky is an American philosopher and one of the most cited scholars alive. In this video, the interviewer suggests to Chomsky that, while we may make an effort to vote in an election or visit a sick friend, what people really want in life is to sit on the couch and enjoy material comfort. Chomsky disagrees.

Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.