Max Bibeau, Preston Sledge, Matthew Kimmell

Join our GroupMe! If you’re not in it already, you’re missing out on live updates about all of our meetings and some fun conversations and predictions about cryptocurrency. And, of course, a good amount of memes.

Like any group of guys with something to say, we’ve started a podcast! Check out our first episode on Soundcloud, hosted by our members Josh and Babar with Texas Blockchain alumni Preston Sledge and Matthew Kimmell.

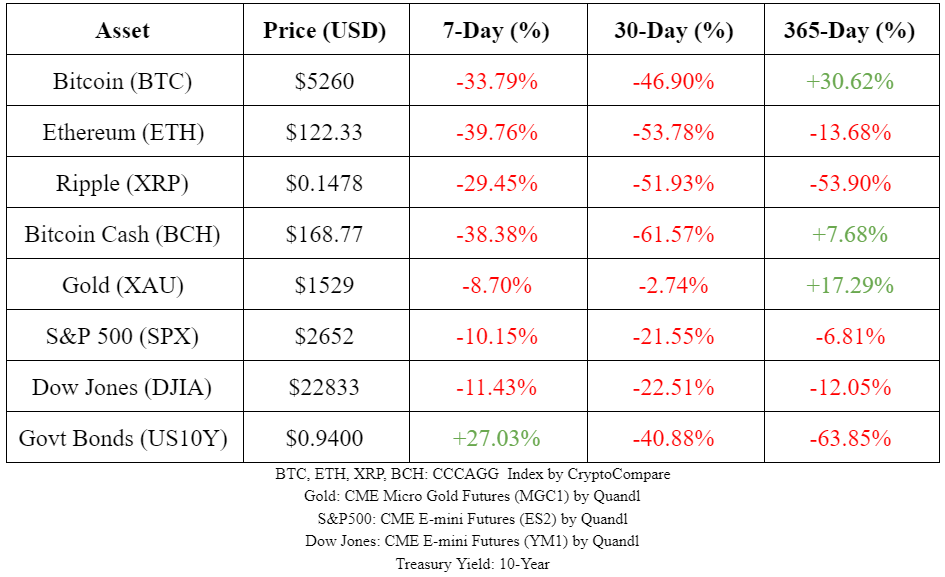

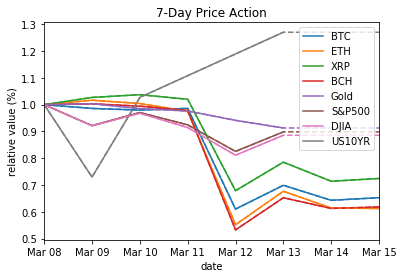

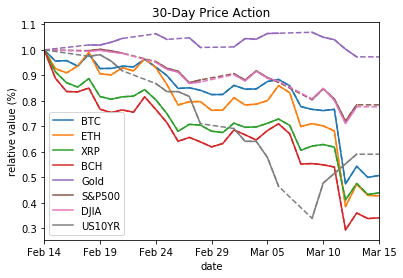

Market Summary

Top Stories

Morningstar Rates Securities Issues on Ethereum Blockchain

Fat Brands, the parent company of Fat Burger, Buffalo’s Wings, and Ponderosa Steakhouse issued $40 million of Class A and B note debt securities rated BB and B by DBRS Morningstar. While the rating itself is on a traditional paper-based debt security, the structuring consultant Cadence issued security tokens to all the investors -- recording the transactions on the Ethereum blockchain. Notably, these security tokens are only “digital representations” of ownership and the use of blockchain will occur “parallel to this transaction and will not govern actual ownership of the notes.”

The Morningstar pre-sale report and Cadence CEO Nelson Chu explained the benefits of tokenizing securities are transparency, as all transactions are viewable through Etherscan, and immutability as information is sequentially encrypted in a continuous manner. Thus far, Cadence has issued 65 smaller, unrated securitizations on the Ethereum blockchain. Their process includes a smart-contracting scheme that airdrops ERC-20 tokens to wallet addresses provided for investors.

CoinDesk Takes Consensus 2020 Virtual

One of the largest gatherings in the industry is going digital in the midst of the coronavirus pandemic. While most conferences are postponed or canceled, crypto publication and host CoinDesk issued full refunds and opened the event for free to anyone with internet access. Although, Consensus 2020 is not the first conference to go virtual; Apple’s Worldwide Developers Conference, The Block’s Summit, and Messari’s Mainnet will all be hosted in virtual environments. Consensus 2020 will take place May 11-13th “in a rolling live TV-like experience.” Check out the speaker list here.

Brave’s BAT Tokens Can Now Be Redeemed for ‘Real-World Rewards’

One of our favorite blockchain use cases here at Texas Blockchain is Brave’s internet browser, which guarantees user privacy and allows users to either choose to block all ads, or receive monetary compensation if they decide to enable ads. This compensation is paid through Brave’s Basic Attention Token (BAT) cryptocurrency, which previously has had extreme limitations on how users can withdraw or distribute funds. However, in a recent announcement, Brendan Eich, the CEO of Brave, stated that Brave will now be partnering with over 250,000 brands, including Amazon, Apple, Walmart, and Uber. This partnership will allow users to redeem BAT for real-world rewards, finally offering a secure and consistent way for users who earn BAT within the Brave browser to receive real-world assets in exchange for their viewing of ads.

First Crypto Victim Diagnosed With Coronavirus After Attending Two Recent Ethereum Community Conferences

Zhen Yu Yong, a Co-founder of the blockchain-based TorusLabs, has announced that he has been diagnosed with COVID-19 (coronavirus) via Twitter. Yong had recently attended two major Ethereum conferences, ETHLondon and the Ethereum Community Conference. He further urged any individuals that had close contact with him at these events to get tested for the virus, and take the necessary precautions to prevent further spreading of the disease. This news comes in the aftermath of the cancellations of many major cryptocurrency conferences, most notably including TOKEN2049, The Paris Blockchain Week Summit, and The Binance Blockchain Week, which were expected to attract thousands of attendees from around the world.

What Happens When All Bitcoin Has Been Mined?

Check out an article published by one of our very own Texas Blockchain members that examines what could happen to the Bitcoin blockchain once all Bitcoin has been released into the Bitcoin ecosystem. Some individuals, like Bitcoin.com’s Roger Ver, believe that the disappearance of a block reward would have a massive impact on miners, and would cause a drastic dip in the number of unique mining operations, eventually leading to a large scale centralization of the Bitcoin blockchain. Others argue that technological advances, both in computing power and energy efficiency, will allow most miners to remain in business, only profiting off of small transaction fees charged to users.

Chart of the Week

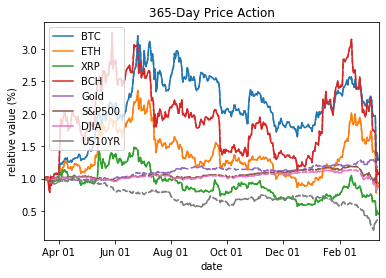

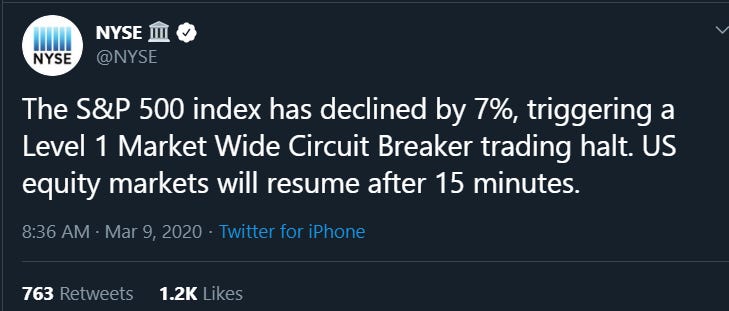

March 12th will forever be an infamous day in crypto as BTC dropped over 52% to a 2020 low of $3861. It seems nothing is safe from coronavirus as the DOW dropped 2000 points in less an hour that morning -- a 17% downfall. While this dramatic price change closed traditional markets, Bitcoin doesn’t close! As a result, it’s likely institutional investors turned to the 24/7 crypto markets to gain liquidity in their portfolio -- selling off BTC. The coronavirus is certainly affecting the macroeconomy for the worse, and this week’s price change makes it clear the BTC safe-haven prophecy hasn’t been fulfilled… yet.

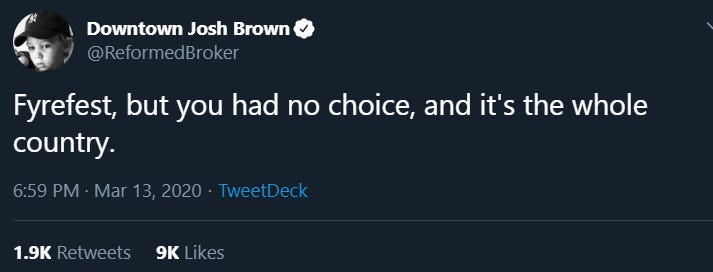

Tweet of the Week

@Josh_Rager echoes the sentiment that institutions are dumping as retail is buying the blood.

@_JustinMoon_ mocks government bond investors, who loan money to the government in exchange for “risk-free” interest. The interest payments are considered risk-free since the government can print money to pay back its debt.

Some consider modern architecture to be bland and conformist, as it favors functionality (steel & glass boxes) over grand design (columns, arches, gargoyles, etc).

@dergigi shares his view from a virtual Bitcoin meetup featuring Alex Bosworth.

A much needed dose of hopium.

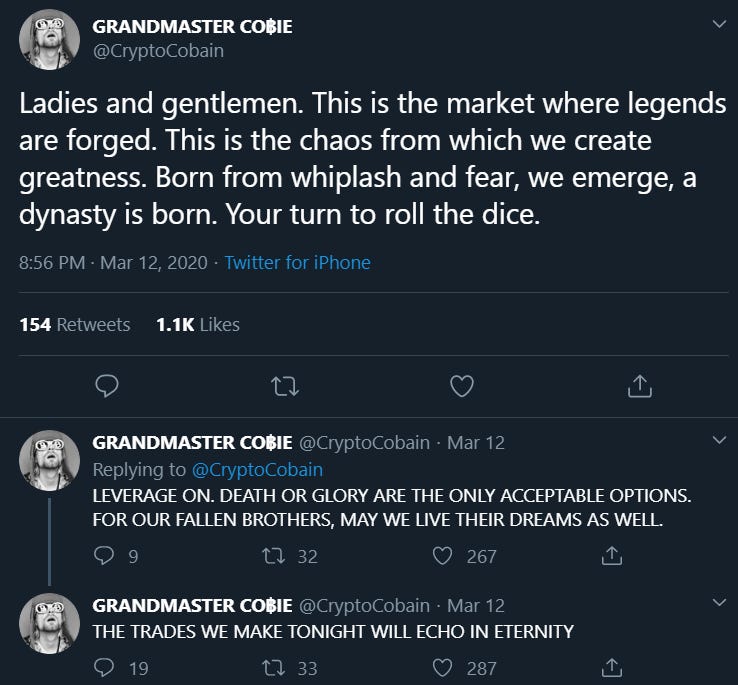

It’s either the beginning or the end of an era. And we’re fucking here for it.

Posted by @TuurDemeester, a chart of oil priced in gold. @zhusu comments that oil/gold mimics ETH/BTC in theory. ETH is used to make things happen, BTC is used to hedge against bad things happening.

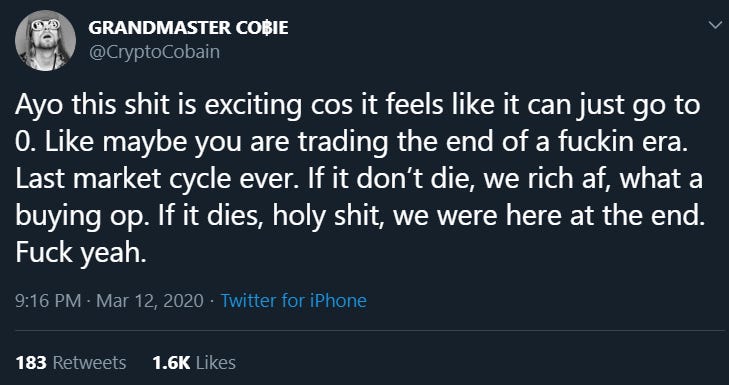

Shared by @vis_in_numeris. Check out the original Big Mac Index.

@gbrew24 breaks down the oil wars sparked by Saudi Arabia and Russia’s flooding of the market. Apparently, these countries became jealous of America’s innovative shale mining, and, smelling blood in the water, began strangling America industry by driving oil prices down.

@TheCryptoDog relates to Donald Trump being irrationally bullish on stonks. Chart by @NorthmanTrader

Hey, us ass-eaters are people too!

The state of entertainment.

This week, under pressure from Trump, the Fed announced it would print $1.5 trillion(!) to stimulate the economy. It seems that CNBC captured the decision live, when anchor Jim Cramer stepped away to answer a phone call from Steven Mnuchin, US Secretary of the Treasury.

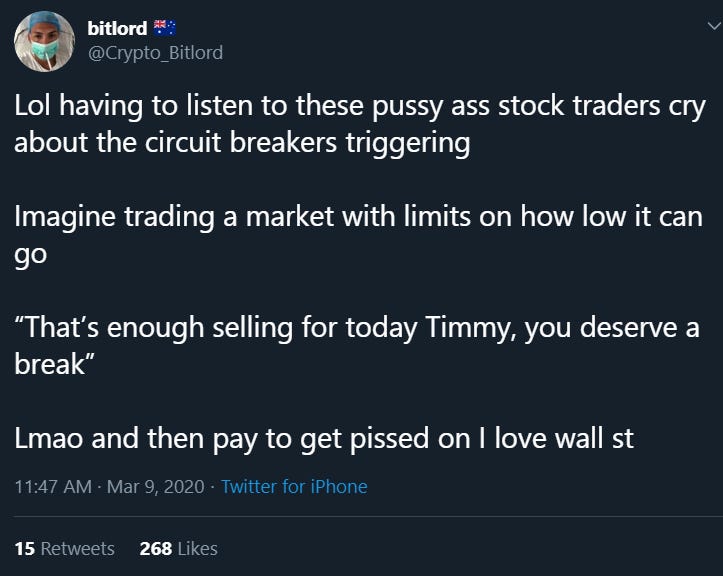

Check out @Crypto_Bitlord getting liquidated on live stream for a good laugh. The Bitcoin market has no circuit breaker!! We prefer our systemic breakdowns privatized and managed by shady companies based in Hong Kong or the Bahamas.

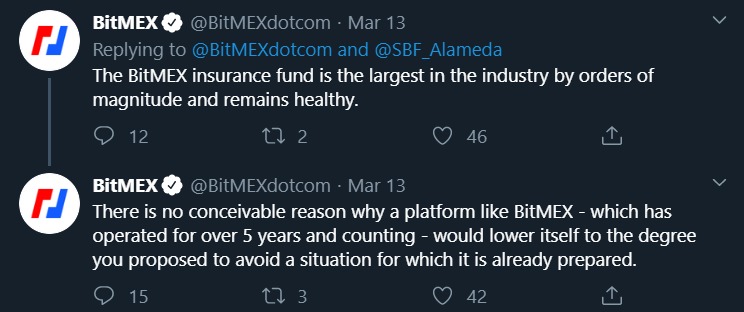

@SBF_Alameda, CEO of crypto derivatives exchange FTX, suggests fellow derivatives exchange Bitmex did customers dirty. The theory circulated Twitter, claiming that Bitcoin’s violent dip was caused by leveraged positions on Bitmex, which triggered a cascade of liquidations that would’ve sent the price of Bitcoin to $0 if they hadn’t ceased trading. More threads by @ThinkingUSD and @lowstrife on the fiasco.

Warren Buffett convinces investors that they’re too stupid to even hold their cash under their mattress.

Video of the Week

Marty Bent invited Parker Lewis (Unchained Capital) and Kyle Bass (Hayman Capital) onto his podcast, Tales From the Crypt, to give the best synopsis on the State of the Market.

Follow us on social media!

Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.