Max Bibeau, Preston Sledge, Matthew Kimmell

Happy Easter! Enjoy both the holiday, and this week’s action packed edition of SOTM from the safety of your home!

Market Summary

Dotted lines represent non-trading days (weekends, holidays, etc.) interpolated to the next trading day’s close price.

Top Stories

Visa Teams With Startup Fold for Bitcoin Rewards on New Card

Mainstream adoption has been one of Bitcoin’s largest challenges since its inception. However, credit card giant Visa Inc. has announced they will be working with a new startup Fold to offer a credit card that rewards users with cryptocurrency, rather than cash back or airline miles. Fold CEO Will Reeves claims that as much as 10% of cash purchases made with the card could be credited back to users as Bitcoin. Reeves went on to explain that while people aren’t necessarily interested in using Bitcoin as money yet, they are interested in accumulating it, so giving crypto as a reward could be a good way to get new users into the crypto space, enhancing adoption.

Fed to Buy Junk Bonds, Lend to States in Fresh Virus Support

As coronavirus continues to challenge the US and world economy, the Federal Reserve has ushered in a new round of emergency measures intended to assist American states and businesses through the crisis. This stimulus comes in addition to last week’s CARES package (~$2 trillion). On Thursday, it was announced that the Fed would be investing up to $2.3 trillion directing aid to small and mid-sized businesses. Additionally, they are funding the purchases of massive amounts of high-yield (junk) bonds, loan obligations, and securities.

Major Crypto Firms Face Class-Action Lawsuits

Over 10 class-action lawsuits were filed in US District court on April 3rd, alleging firms had sold unregistered securities in the form of crypto tokens. Those targeted include centralized exchanges Binance and BitMEX, as well as notable crypto projects Tron, Civic, Block.One, and Kyber Network. The plaintiff’s attorney emphasized how issuers and exchanges have manipulated markets and profited from listing digital assets. In a statement released Monday, he claimed “the alleged pattern of misconduct by exchanges and issuers yielded billions in profits for wrongdoers through a basic betrayal of public trust.”

Bitcoin Halving: How Miners are Preparing for Lower Block Rewards

If you’ve been keeping up with cryptocurrency, you’ve probably heard about the upcoming “halvening,” an event which reduces Bitcoin’s block rewards to be half of its previous amount. This decreases the inflation rate for Bitcoin holders, but also decreases the revenue for miners ‒ which can jeopardize the security of the network. This podcast/article presented by CoinDesk analyses some of the ways that Bitcoin miners are preparing for this event, including teaming up with local governments and bargaining for excess electricity.

Top Charts

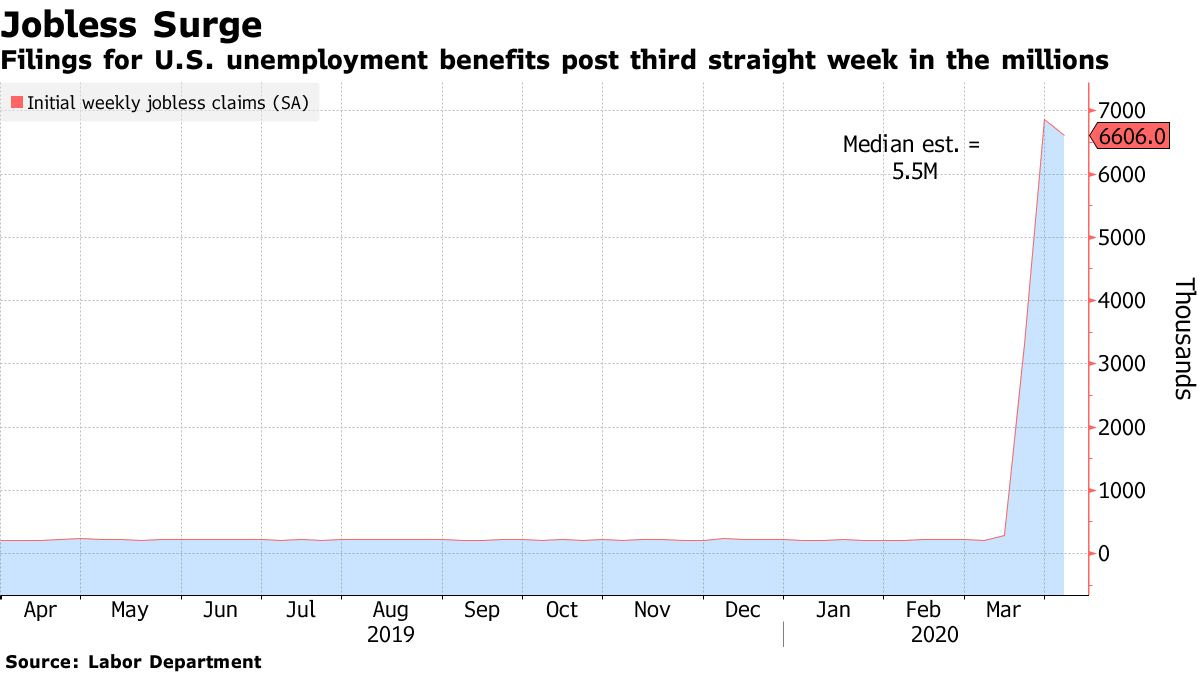

This chart, sourced from Bloomberg, is helpful in realizing how radically the coronavirus is transforming our economy. For the third week in a row, millions of individuals are filing for unemployment, a trend that is totally unprecedented.

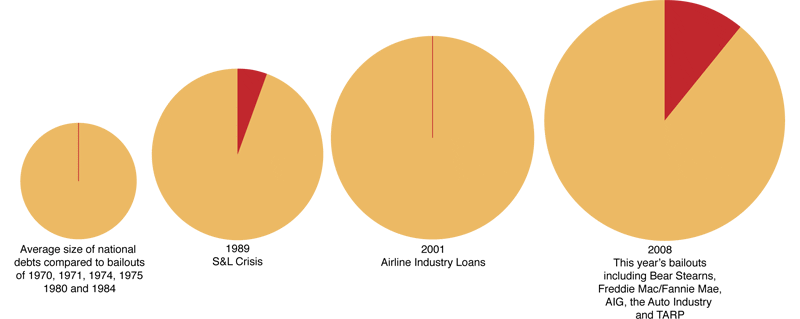

In more coronavirus news, these fun pie charts show the approximate cost of national bailouts compared to total national debt (sourced from ProPublica). I wonder how crazy the 2020 coronavirus bailouts chart would look?

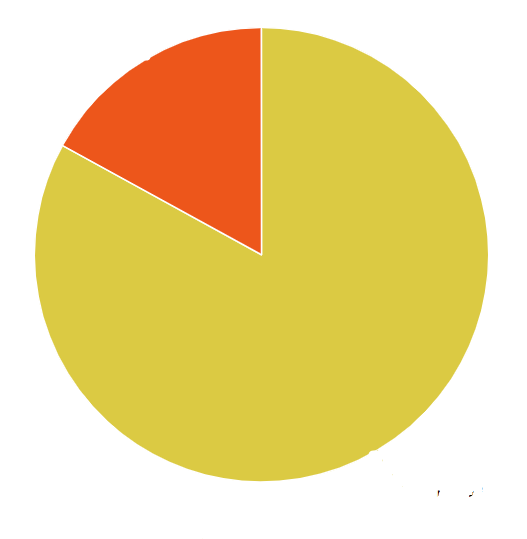

Turns out, it surpasses the 2008 bailouts, and by a significant margin. It comes out to about 17% of national debt. The numbers used are obviously pretty rough (approx. $4.3 trillion in bailouts, approx. $25 trillion national debt = ~17.2%). But still. Scary!

Corporate Debt

From @DTAPCAP: “Investment grade corporate bond index back to near ALL TIME highs. Fed buying junk bonds too. Risk of bankruptcies reduced even with 20M unemployed. Unprecedented ‘unlimited’ liquidity could not be more bullish for gold and BTC.”

Top Tweets

State-funded corporations. State-sponsored bailouts. State-enforced income redistribution. State-controlled money. But, if they can keep up the facade of a free market, then we’ll keep chasing the American Dream! For governments, “crony capitalism” is more profitable than outright socialism, since it preserves our motivation to work. Suck it, Soviets! We’re #1!

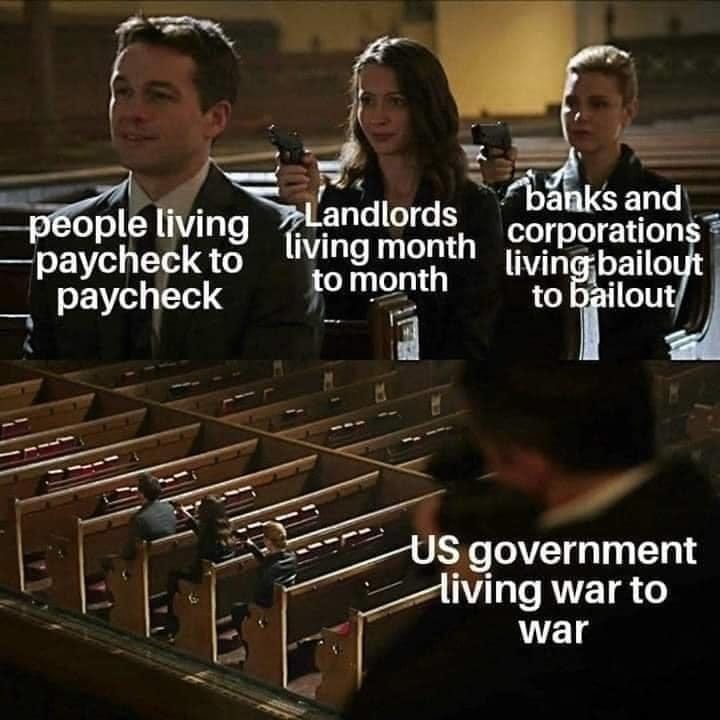

The extortion chain. From @AlisonBuki.

It takes a while to turn Capitalism crony. If you drop a frog in boiling water, it will jump out immediately. But, if you place a frog in warm water and turn the temperature up by 1 degree every hour, the frog will slowly boil to death.

@nic__carter reiterates that inflation is not the root of the problem. He identifies politically-controlled money issuance as the reason for Capitalism’s decline. Inflation aside, the US Dollar’s issuance is arbitrary and based on political favoritism; Bitcoin’s issuance is pre-determined and based on “work”.

Pic of the week. The Cantillon Effect in action. Those close to newly issued money (banks & corporations) benefit at the expense of those downstream (workers). We’ll eventually receive those measley checks i.e. hush money, but not before asset prices have already been bid up by insiders. However, “BioAnal”. LMAO.

The Fed: “You think $1,200 is enough to shut them up while we bail out the boys?” Stimulus checks to citizens are estimated to total $300B in payouts. This means that the American public, at record unemployment, has received just 7% ($300B / $4.3T) of the Fed’s stimulus, while most of the money has gone to bail out owners of corporations. Meme from @EpsilonTheory.

@Neil_Irwin gets the “money printer go brrr” meme into the New York Times.

@jack, CEO of Twitter and Square (CashApp), creates a direct on-ramp for people to funnel their government checks into Bitcoin, “no bank account needed”.

@jack also donated $1B to fight coronavirus, claiming the sum to be about 28% of his wealth. He told journalists, “You’re not gonna ratio me.”

@balajis continues the big tech vs. journalist showdown, which started with media outlets like Vox, Recode, Buzzfeed, etc. attacking tech billionaires for their coronavirus donations (“muh only 1% of net worth”) after publishing “just-the-flu” stories leading to potentially thousands of deaths. Now, Vox is requesting donations from its readers to fight coronavirus ‒ while having raised $300M+ over 8 rounds of funding.

“B-B-But they MUST HAVE exploited people.”

Looks like the market could use a diet.

A thread by @moxie on the mechanics of Apple + Google’s new tracing application for the coronavirus.

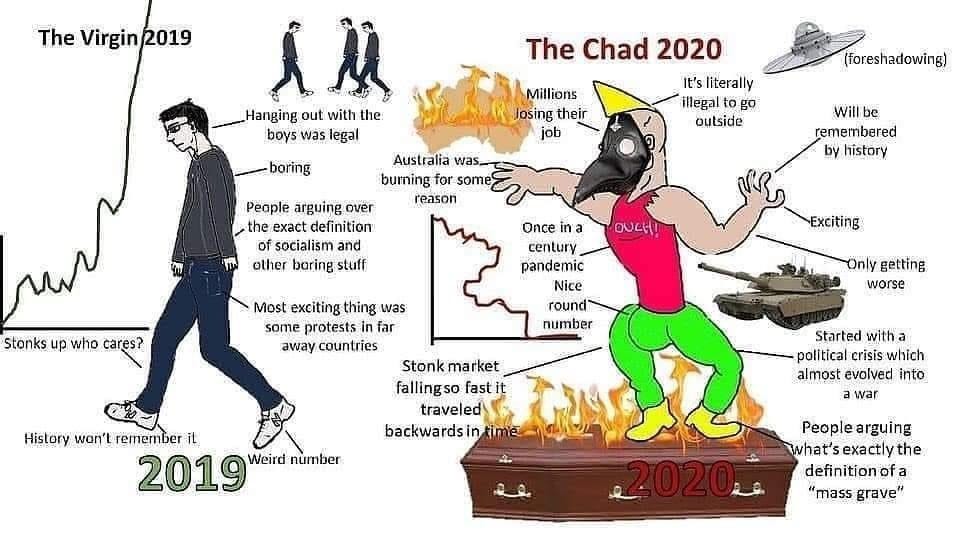

1933: Hard times create strong men.

2020: Quarantines create chads.

Reddit X Ethereum collab leak. From @Crypto_Guy_UK.

Imagine still being political.

We out here overcoming challenges.

Top Videos

@chamath, CEO of Social Capital and Owner of the Golden State Warriors, gets cold-blooded on national television. He advocates for letting corporations fail, which stuns the interviewer. Chamath clarifies that bankruptcy does not screw over a company’s employees, but only its equity and debt holders. Check out the meme version, too.

Dave Portnoy, CEO of Barstool Sports, takes the Fed’s ridiculousness mainstream: “Let me tell you something about the Fed… We’re dealing with Schrute Bucks at this point… If you flood the market with quatrillions, then the quatrillions mean nothing. That’s basic economics.” Check out Portnoy’s adventures as a day trader, too.

Ray Dalio shares his investment thesis for the crisis: “You should think a little bit unconventionally. Do you have a little bit of gold? Do you have a little bit of… um… in case this monetary system breaks down and money is redefined. Do you have a little bit of that?”

Follow us on social media!

Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.