Max Bibeau, Preston Sledge, Matthew Kimmell

As the coronavirus crisis continues to drag on, we hope this edition of SOTM can keep you entertained! Have a great week.

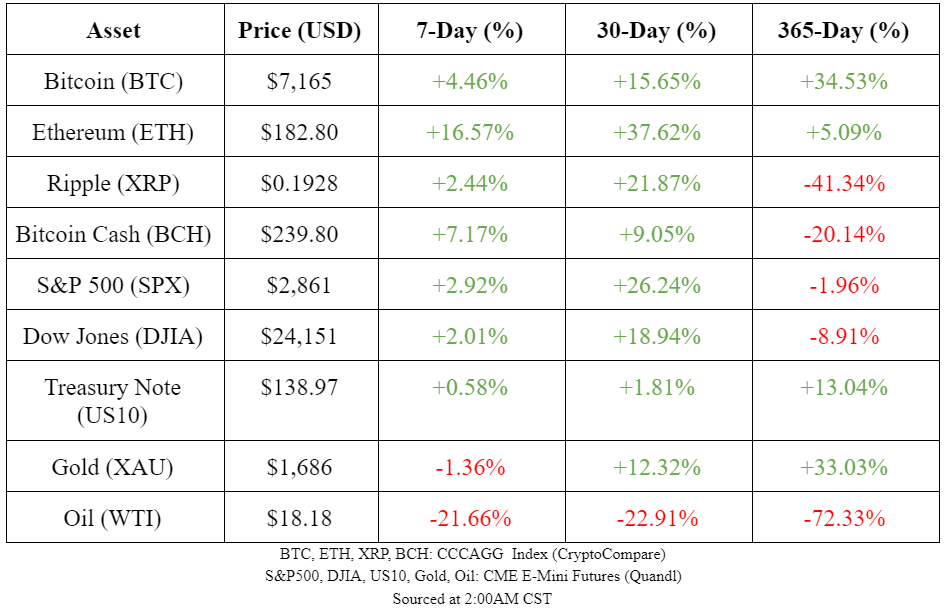

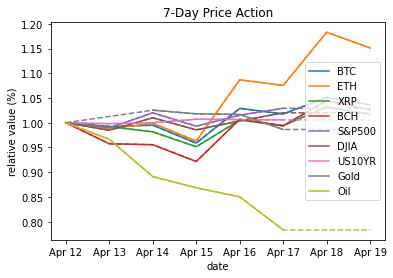

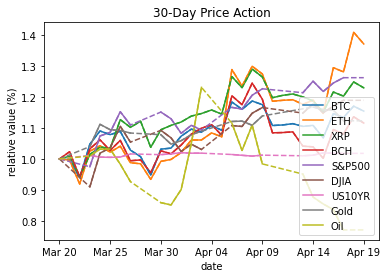

Market Summary

Dotted lines represent non-trading days (weekends, holidays, etc.)

Top Stories

How Tesla And BMW Are Leading A Supply Chain Renaissance With Blockchain

This article from Forbes shines a light on how major companies are using blockchain to enhance their supply chains. Currently there are many major brand suppliers, including Costco Shipping, who are part of the so-called “blockchain consortia” Global Shipping Business Network, waiting for regulatory approval.

DeFi Startup Compound Unveils Governance Token in Decentralization Push

Compound (COMP) is an open finance startup that has announced their development of a governance token, which will allow holders to “suggest, debate, and implement changes to Compound — without relying on, or requiring, our team whatsoever.” While the decentralization project will be gradual, an initial sandbox period is expected soon that will test the token with current shareholders. Eventually, all COMP tokens will be distributed to the general public, where Compound CEO Robert Leshner explains that “users who possess 1% of COMP tokens can submit a governance proposal,” including “adding a new asset or instituting changes to a market's interest rate model.” The proposal is then put up to a vote where all token holders can voice their opinions. If the proposal passes, it is implemented 2 days later. This system of community governance is a radical change from typical corporate boards, so this project will be interesting to keep an eye on.

Stablecoin Demand Foreshadows Financial Disruption

The market cap for stablecoins exploded this week. However, rather than trading Bitcoin with these tokenized dollars, many believe that people are using stablecoins to quench their thirst for dollar-denominated liquidity. People in foreign countries use US Dollars to settle transactions, especially when they can’t trust their own national currency. But, local banks can manipulate the market for dollars in these countries. Stablecoins provide unencumbered access to dollars. Stablecoin issuers use a public ledger, reside in financial safe havens, and generally don’t censor transactions. These issuers take a hands-off approach, allowing users to opt out of their local system and freely transact in dollar-pegged tokens. Also, stablecoins are programmable. Open financial services (DeFi) increase the utility of stablecoins vs. legacy dollars. With stablecoins, not only can anyone with an Internet connection transact in US Dollars, but they can also earn a yield on their holdings without using traditional intermediaries.

Top Charts

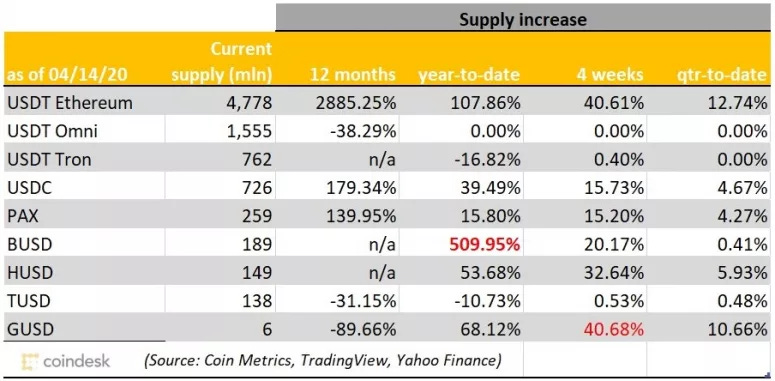

This chart shows the recent growth of stablecoins. Market cap = supply X price. Since the price of each token = $1, a stablecoin’s supply = its market cap.

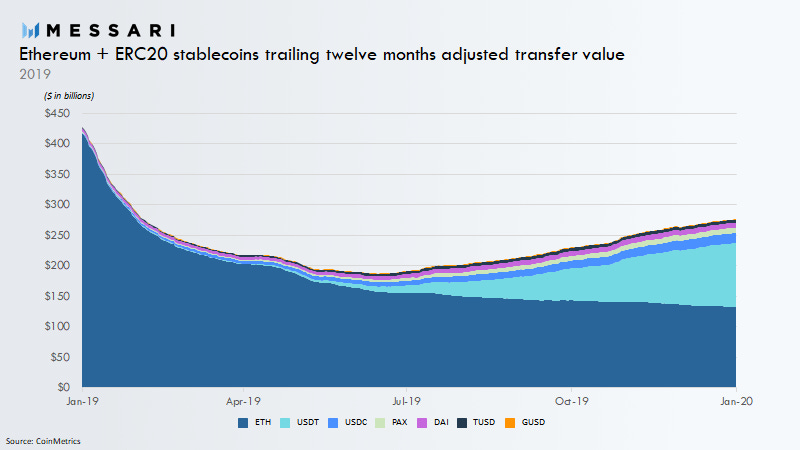

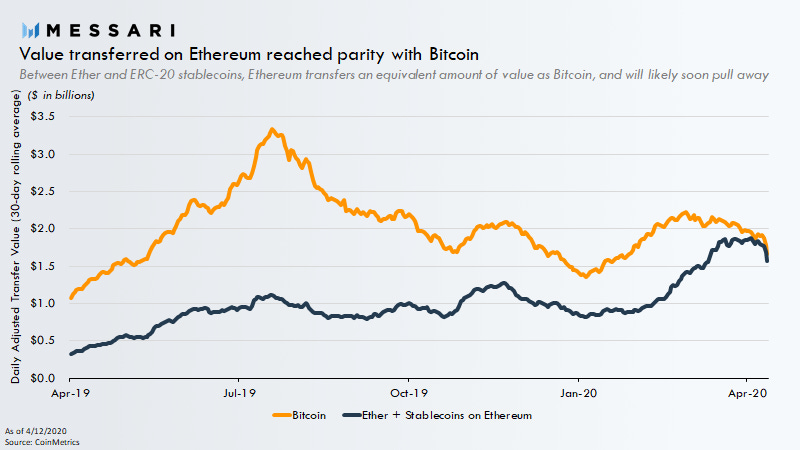

Tether (USDT) is the biggest stablecoin with a ~$7B market cap and ~$750M in daily trading volume. Tether is a multi-headed hydra, splitting its supply among the blockchains of Bitcoin, Ethereum, Tron, EOS, Algorand, and Bitcoin Cash. Now, the growing volume of Tether’s ERC-20 token is pushing Ethereum to facilitate more total value (in $) than Bitcoin. However, @udiWertheimer points out that the chart omits Tether transactions on Bitcoin, whose Omni layer supports ~$1.5B USDT (vs. ~$5B USDT on Ethereum.)

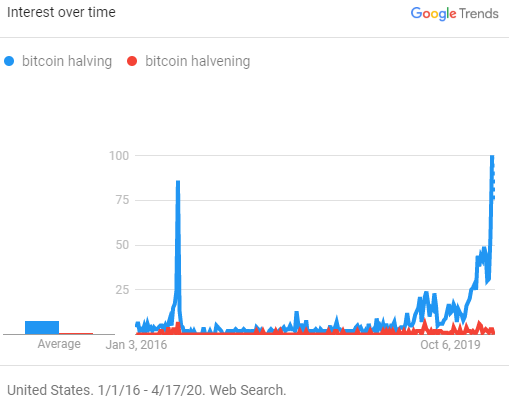

Ok, so it’s officially the Bitcoin “halving”, not “halvening”. This year’s timely halving, estimated for May 2020, will take place on a bigger stage than Bitcoin’s last round of Quantitative Hardening (QH) in July 2016. Chart from Google Trends.

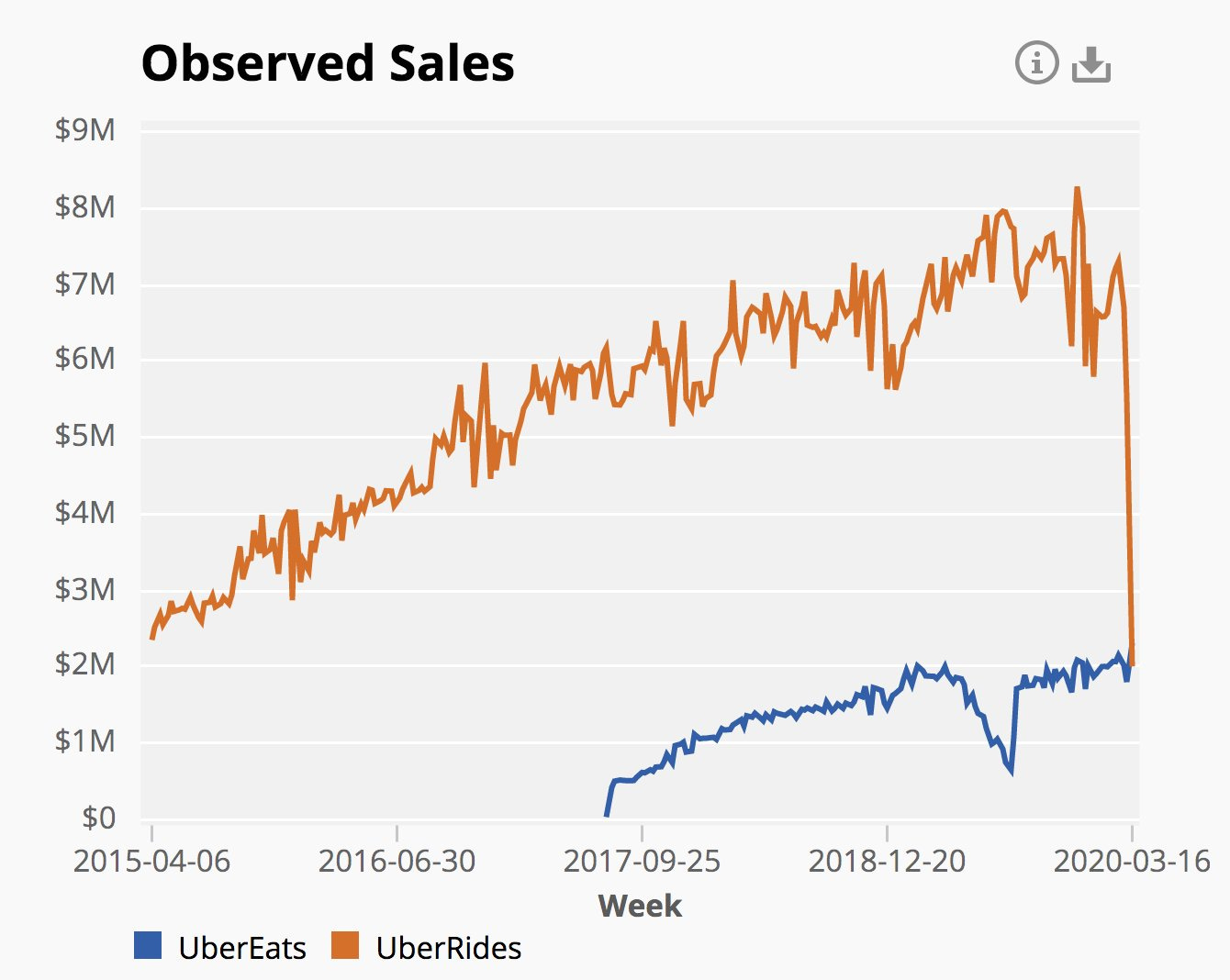

For the first time, UberEats generates more revenue than Uber rides. This chart demonstrates the importance of a diversified portfolio.

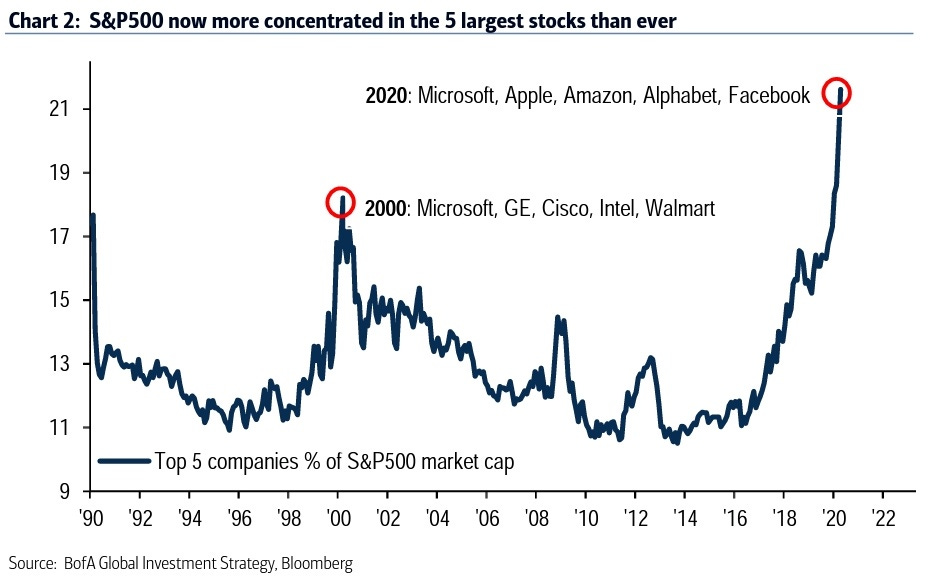

Information technology has lowered barriers to entry, but “network effects” have created tech monopolies. Now, five (info tech) companies command their largest-ever share of the US stock market. From @chigrl.

Top Tweets

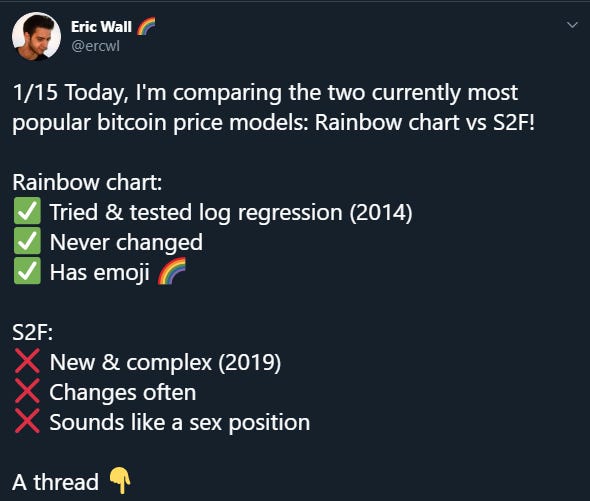

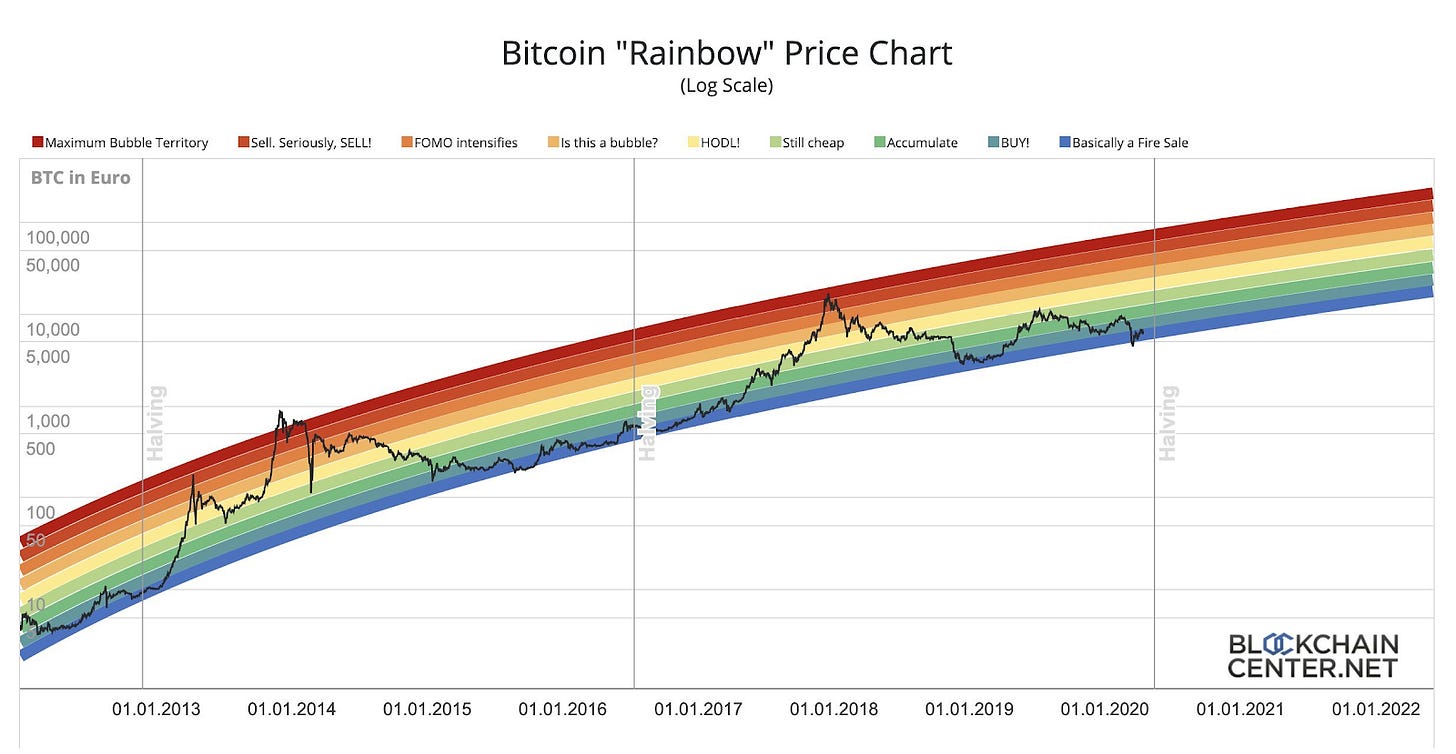

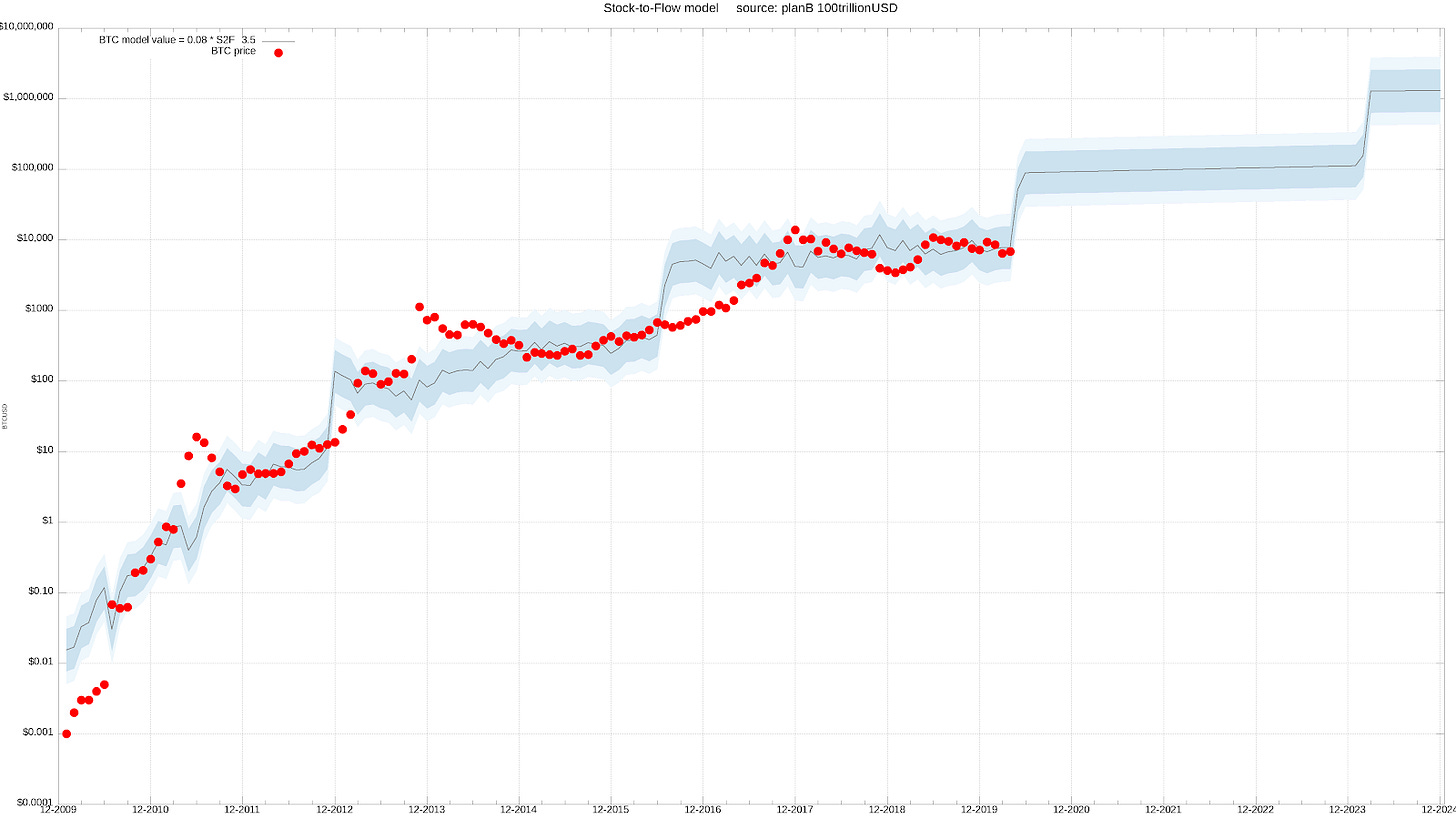

@ercwl posits that ‒ when it comes to predicting the price of Bitcoin ‒ the Rainbow trend is a more useful model than popular Stock-to-Flow (S2F) regressions.

@Travis_Kling highlights how the US Dollar Index (DXY) is back at levels when the SPX was at an all-time-high -- even after $6tn of monetary and fiscal stimulus. The DXY measures the value of the dollar relative to a basket of foreign currencies. With the dollar gaining relative strength, Kling proposes “this is The Dollar Shortage and it let's you do things previously unthinkable.”

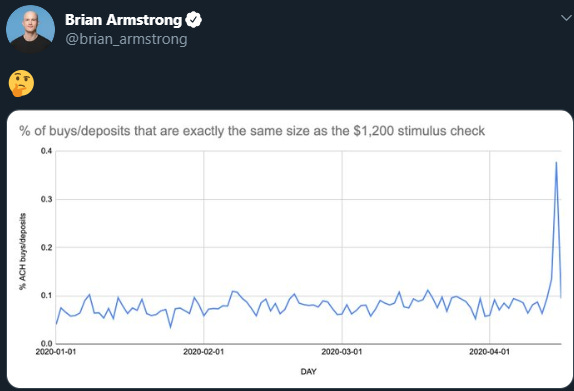

And don’t forget Bitcoin! @brian_armstrong, CEO of Coinbase, shows that the % of buys on Coinbase for $1,200 worth of cryptocurrency bubbled last week.

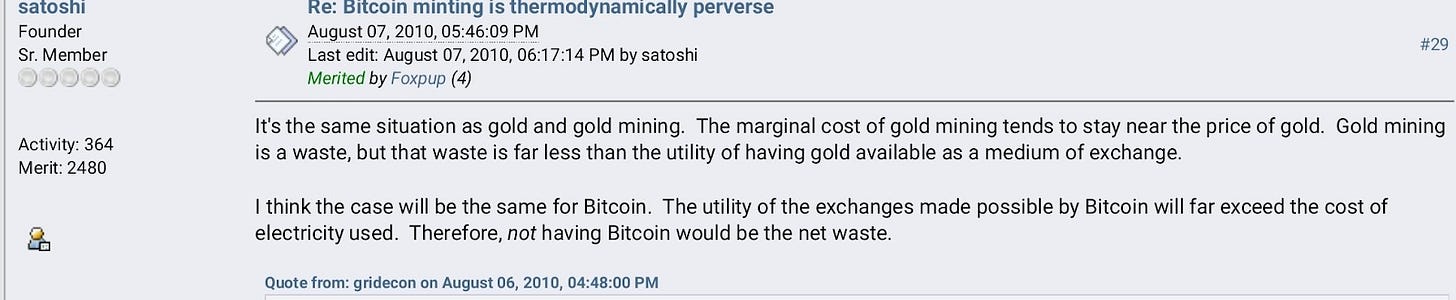

A nugget from Satoshi, the mysterious creator of Bitcoin. Screenshot from @MrHodl.

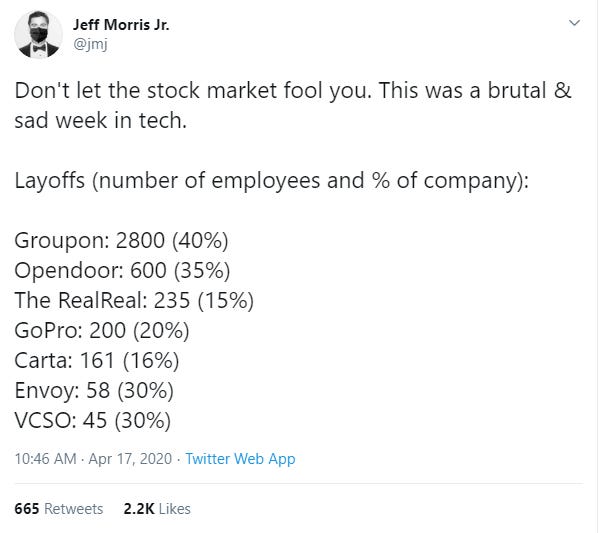

Following up on last week’s unemployment news, people are still losing their jobs... but go stonks! From @jmj.

@Atomic_Loans is facilitating Bitcoin-backed loans. Their platform allows users to borrow stablecoins using Bitcoin as collateral or lend stablecoins and start earning interest. Furthermore, the loans are non-custodial, meaning all funds are managed by smart contracts on Bitcoin and Ethereum.

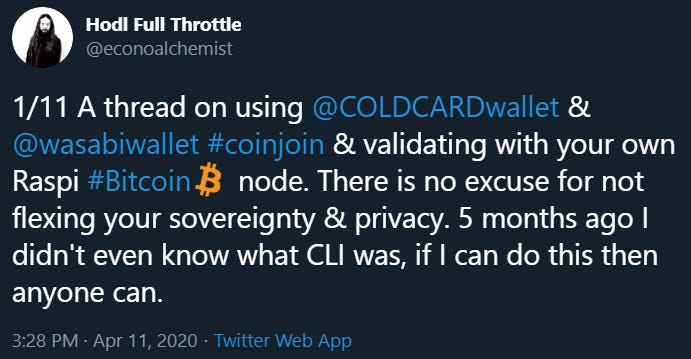

Bitcoin for the modern cypherpunk: Raspberry Pi (Bitcoin software) + 1 TB SSD (Bitcoin blockchain) + Coldcard (cold wallet) + Wasabi (coin mixing/hot wallet).

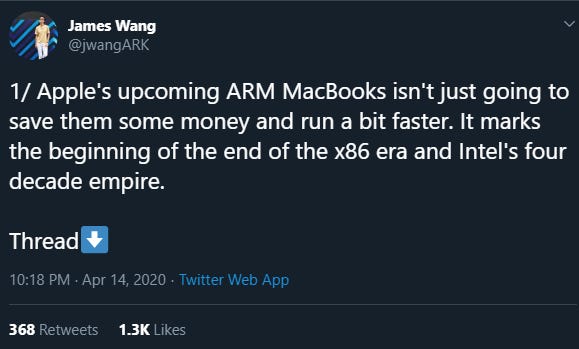

This seems big for computers.

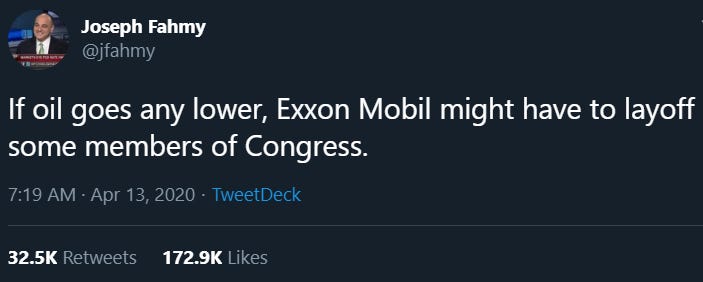

Anyone buying? No? Send in the Fed.

@jenzhuscott compares America’s coronavirus task force to a group of sketchy ICO advisors.

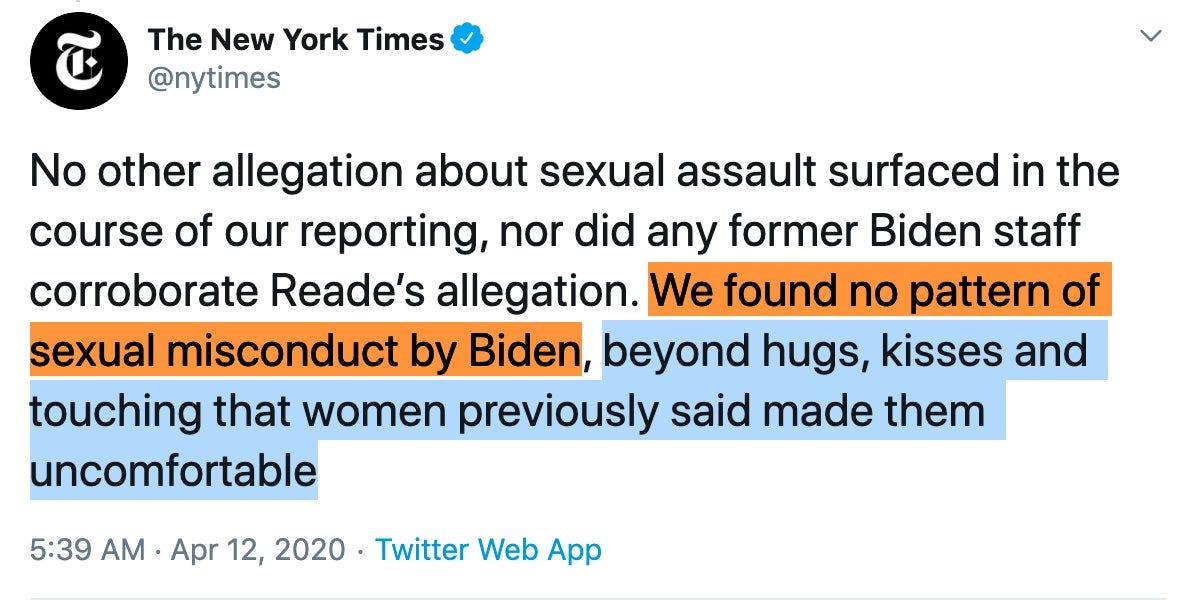

Yeah… so… wait what?

From @notgrubles. The meme depicts @zooko cooly extending the Zcash (ZEC) “Founders Reward”, which now siphons 7% of every block reward to developers at the Electric Coin Company (ie. @zooko) and 5% to investors at the Zcash Foundation.

This political cartoon portrays the dominance of the Chinese Communist Party. The cartoon captures #ChinaLiedPeopleDied, which trended this week. From @jkylebass.

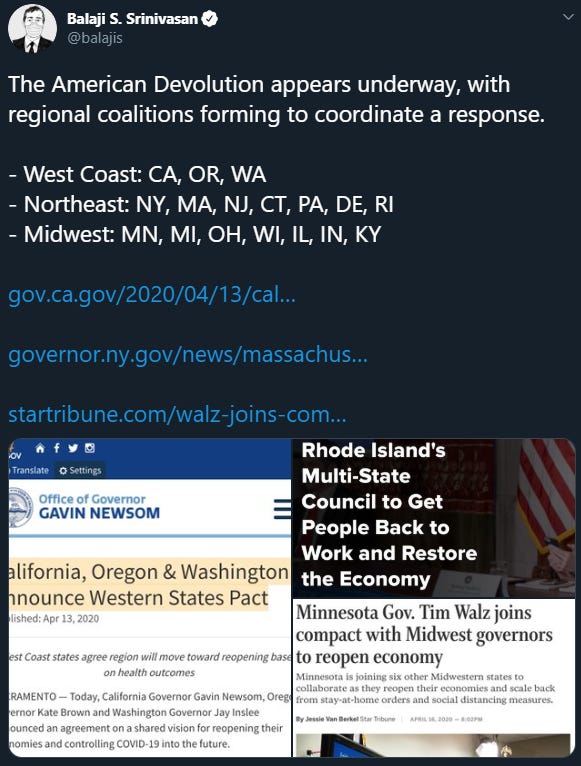

According to @balajis, America is decentralizing, evidenced by the States forming coalitions and taking virus-related matters into their own hands. #SECEDE #Texit

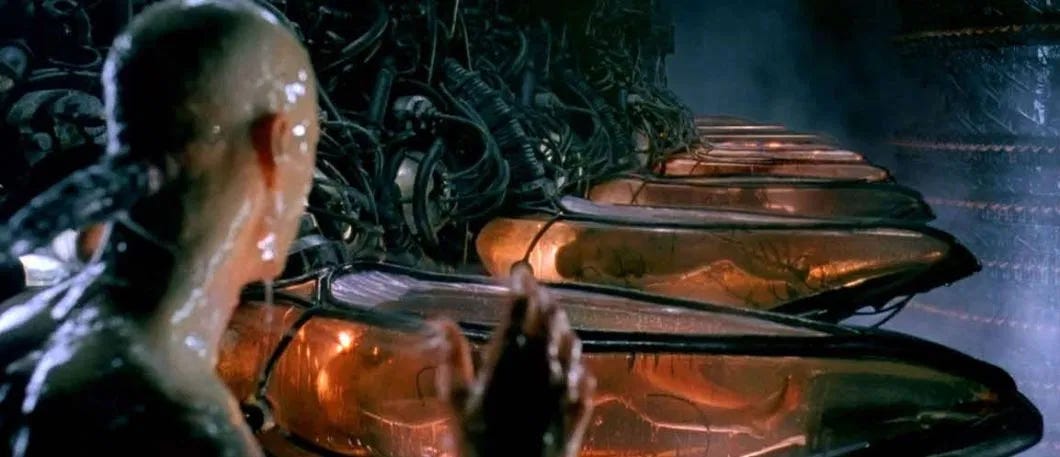

From Microsoft: “The cryptocurrency system communicatively coupled to the device of the user may verify if the body activity data satisfies one or more conditions set by the cryptocurrency system, and award cryptocurrency to the user whose body activity is verified.” Groundbreaking research or the plot to Black Mirror (S1 E2)?

Shot, Chaser.

1) From @erinnakamoto and 2) From @AGleaks.

When zombies? From @elonmusk.

Top Videos

This documentary, Out of Shadows, got 5M views in 4 days before Youtube removed the original video. Also this week, Amazon removed Hoaxed, the #1 best-selling documentary on iTunes, from its online movie platform. These conflicts of interest remind me of Dave Chapelle’s most recent standup (on Netflix), which received a 99% rating from Rotten Tomato users and 0% from Rotten Tomato critics upon release. Warning: They don’t want you to see this.

Bitcoin going #BeastMode.

Follow us on social media!

Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.