Keith Asmussen, Joshua Ebedes, Max Bibeau, Preston Sledge

The Earth continues to spin!

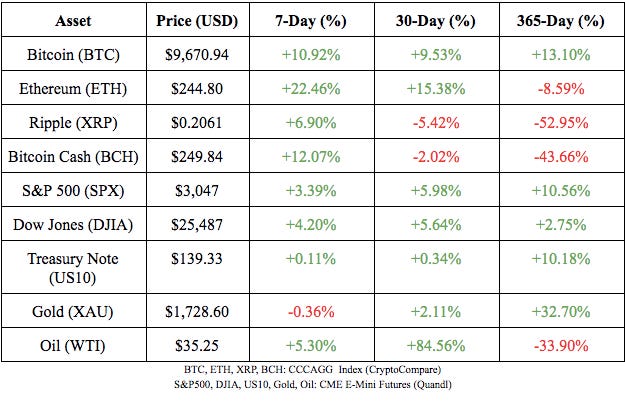

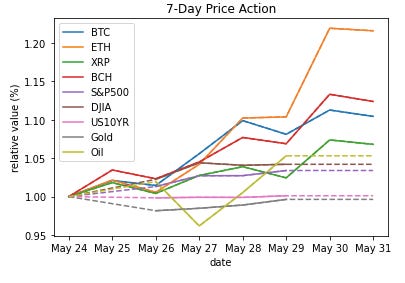

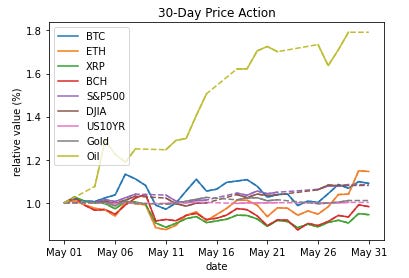

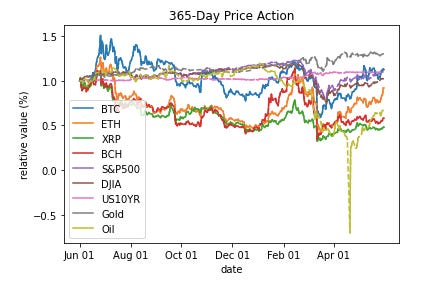

Market Summary

Dotted lines represent non-trading days (weekends, holidays, etc.)

Top Stories

Goldman Sachs Slams Bitcoin And Gold On Investor Call, Crypto Community Reacts

Goldman Sachs hosted a conference call on “US Economic Outlook & Implications of Current Policies for Inflation, Gold, and Bitcoin.” Prior to the call, some believed that the investment bank would be warming up to bitcoin around the recent unprecedented economic events.

Rather unsurprisingly, the presentation proved to be a severely critical analysis labeling “Cryptocurrencies Including Bitcoin Not an Asset Class” for the reasons of:

Not generating earnings or cash flows

Too volatile for consistent diversification

Showing no evidence of being a hedge to inflation

Susceptible to inadvertent loss and hacking

Conduit for illegal activity

Goldman Sachs Full Presentation

Following Goldman’s scalding presentation on Bitcoin, the crypto community easily jumped its defense as the slides of the presentation are not cogent. Gemini founder Cameron Winklevoss pointed out that the Commodity and Futures Commission declared Bitcoin a commodity in 2015. Also important to note that Goldman was bearish on the internet in 1994.

Grayscale Is Now Buying 1.5 Times the Amount of Bitcoin Being Mined

Contrary to the opinion of Goldman Sachs, Wall Street wants in on Bitcoin. With only 12,337 BTC mined since The Halvening on May 11th, Crypto fund manager Grayscale Investments have added over 18,910 BTC to their Bitcoin Investment Trust accumulating 60,762 BTC over Q1. Independent researcher Kevin Rooke announced this estimate over Twitter stating that: post-halvening, Grayscale is accumulating 1,112.35 BTC a day. To which Grayscale founder Barry Silbert replied, “Just wait until you see Q2.”

Ethereum’s Vitalik: We Need an Alternative to Centralized Social Media

Vitalik Buterin, co-founder of Ethereum, comments on the need for an alternative to our current social media platforms. Recently Twitter decided to flag some of President Donald Trump's tweets as fake news. This act by twitter has led to an increase in the voices calling for uncensored and decentralized social media.

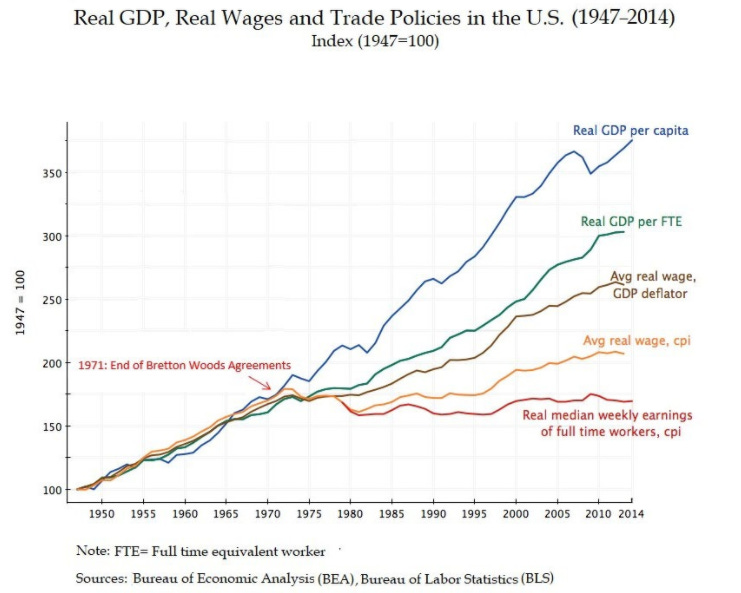

Graph of the Week

This graph is sourced from wtfhappenedin1971.com. This site houses tons of graphs and images that detail the results of President Nixon taking the US off of the gold standard. Recently the traffic to the site has exploded. Wonder why…

Top Tweets

@jenniferatntd reminds us that really important things are going on in the world that don’t involve Covid

@prestonjbyrne Explains Section 230 of the Communications Decency Act and why twitter wont be sued for censorship and moderation calls.

Thank you @ne0liberal. I have been long doge memes for the past year or so and people thought I was outdated.

@JimmyRagosa. Ouch…

@vcorem I can’t wait for Q2 earning reports

@CryptoCharles tweets a picture of what the world would look like with 100% Bitcoin adoption

@allenf32 shares @clay_space ‘s AI formulated Crypto White paper. These AI’s are getting crazy good at writing like humans. When I first read it I could have sworn it was made by a club member of ours.

Video of the Week

Why Goldman Sachs Is Wrong About Bitcoin

CoinFund Managing Partner Seth Ginns and Fundstrat analyst David Grider discuss Goldman Sach’s conference call, risk management strategies, and current state of the Bitcoin market.

Follow us on social media!

Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.