___________

Club News

Hey everyone, I am very excited that we will be bringing back the in-person certificate program next semester. The certificate program is an educational program that is done weekly and teaches the basics of blockchain all the way to learning solidity(Coding language for Ethereum). Something new that we have not done is having companies come in to teach a concept that can you give members exposure to internship opportunities. If you have any interest, the google form is below.

Also, to clarify the certificate is not associated with the University of Texas and you will not receive any class credit.

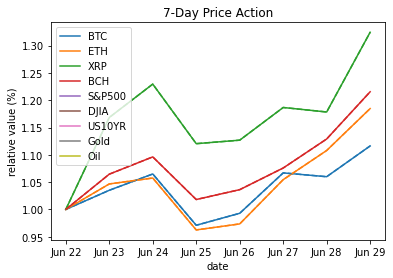

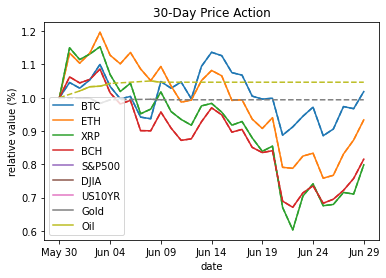

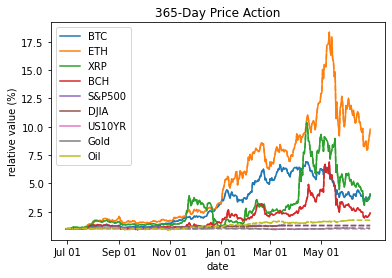

Market Summary

Top Stories

Ethereum London upgrade launches on testnet as 100K staked in a day on Eth2

Ethereum’s highly anticipated London upgrade which contains the improvement proposal 1559 has been launched on the Ropsten testnet.

Following the launch on Ropsten on Thursday, London is now expected to progress through Ethereum’s Goerli, Rinkeby and Kovan testnets at roughly weekly intervals — from which point the Ethereum community expects a date for mainnet deployment to firm up.

The new upgrade will see transaction fees burned. According to the EIP-1559 tracking website Watch the Burn, roughly 88,500 testnet Ether (ETH), nominally worth $177.6 million, has been burned on Ropsten over the day since London’s deployment.

Mexico's Rollercoaster Week

Ricardo Salinas, Mexico's third-richest person, announced that his bank is preparing to accept Bitcoin Just a day after, Mexico's central bank moved to shut the plans down.

The businessman was seen extremely bullish on Bitcoin during an interview, which he followed by tweeting that his bank, Banco Azteca, one of the largest in the country, was arranging everything to accept it.

"I highly recommend the use of Bitcoin, and my bank and I are working to be the first in Mexico to accept it," wrote the Mexican millionaire on his Twitter account in response to a post from Michael Saylor.

Salinas Pliego said that Bitcoin should be every investor's portfolio, and attacked fiat currencies by calling them a "fraud" and "stinky", recounting the story of how the Mexican peso lost its value in a dramatic fashion in the 80s. The controversial billionaire said that he has 10% of his liquid portfolio invested in Bitcoin. According to the Bloomberg Millionaires Index, Salinas' fortune has risen $2.8 billion this year, reaching $15.8 billion.

However, on Monday morning, Mexican financial authorities rejected the idea that banks in the country may be authorized to carry out operations with cryptocurrencies.

"The financial institutions of the country are not authorized to carry out and offer to the public operations with virtual assets, such as Bitcoin, Ehter, XRP and others in order to maintain a healthy distance between them and the financial system", highlighted Hacienda (Mexico's Treasury), Banxico (Mexico's central bank) and the CNBV (Mexico's SEC) in a statement. In addition, they indicated that the institutions that carry out or offer operations with virtual assets without authorization will be sanctioned.

According to the Secretary of the Treasury, Arturo Herrera, the joint position of the Treasury, Banxico and the National Banking and Securities Commission, is that cryptocurrencies are prohibited in the Mexican financial system and at the moment no changes are foreseen in this regard in the near future. Herrera further explained that the position regarding these assets is not new, since a currency must have three characteristics: be a unit of measurement, a medium of exchange and a store of value. "Clearly cryptocurrencies are not stores of value, it is an asset that today is considered speculative. Due to its variations, it is not a means of exchange," he declared.

Brazil Stock Exchange Lists First Bitcoin ETF in Latin America

More on the news in Latin America, a Brazilian stock exchange, known as B3 just listed its first Bitcoin ETF. In March, The Brazilian Securities and Exchange Commission approved the ETF of QR Capital, a Brazilian firm focused on providing venture capital to companies working in the field of digital currencies and blockchain, to trade on B3. B3, the Sao-Paulo based stock exchange, serves as the largest exchange by capitalization in the entire region.

Despite being the first of Bitcoin, this is the second cryptocurrency ETF in Brazil. The HASH11, which offers exposure to various crypto assets, has been trading in the Brazilian market since last year.

TP ICAP partners with Fidelity, Zodia Custody and Flow Traders to launch new platform

TP ICAP, a global firm of professional intermediaries operating in the world’s financial energy and commodities markets, announced that it will launch a cryptocurrency trading platform with Fidelity Digital Assets, Zodia Custody, and Flow Traders. One of the initial liquidity providers for this new platform will be Flow Traders, which is a company that used to specialize in ETF liquidity but has now expanded into digital assets as well. The new platform will aim to provide a marketplace for spot crypto asset trading and provide post-trade infrastructure into a network of digital asset custodians. Fidelity Digital Assets and Zodia Custody will be the ones who aim to provide secure, theft-free, custodian services to the new platform.

Compound Labs Launches ‘Treasury’ to Get Big Firms Reaping DeFi Yields

DeFi firm Compound Labs, also the creator of Compound Finance on Ethereum, has a new company called Compound Treasury. In collaboration with Fireblocks and Circle, Compound Treasury will let Neobanks (firms that offer internet-only financial services with no physical branches) and Fintech firms send dollars that are converted into USDC, a dollar-backed stable coin that Circle administers in partnership with Coinbase. Then, the USDC tokens will be deployed on Compound Finance protocol for a guaranteed interest rate of 4%, which is better than anything firms receive from a savings account or even a certificate of deposit. Compound Treasury will slash switching costs by allowing users to get in and out whenever they want without any commitments to lock their assets up for a certain period. CEO of Compound Labs, Robert Leshner, believes that this project “could be shockingly big and shockingly profitable.”

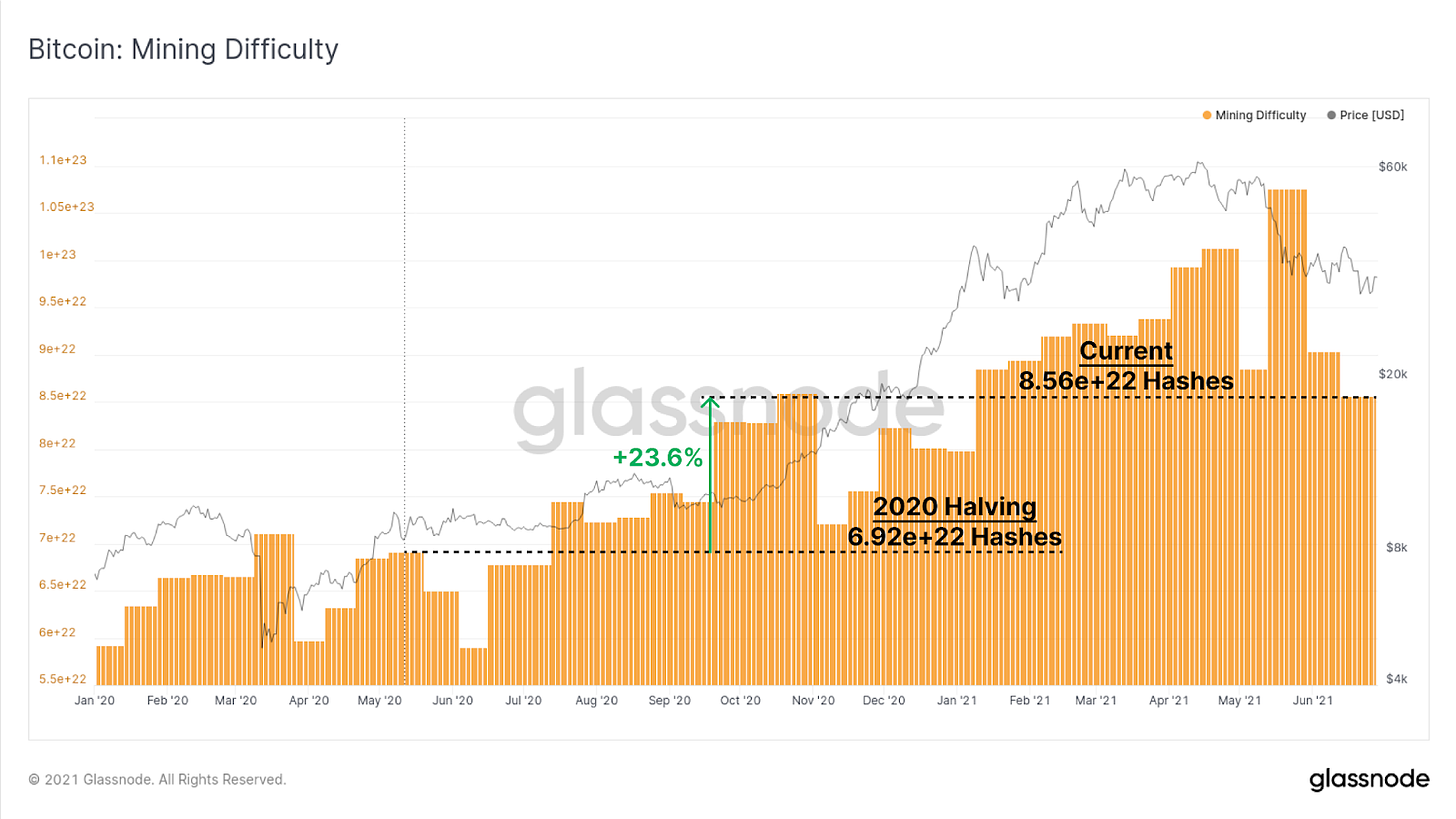

Chart of the Week

After China’s recent shutdown of mining operations, a very large proportion of hash-power is currently offline and in transit, and the next difficulty adjustment is estimated to be -25%. As such, miners who remain operational are likely to become even more profitable over the coming weeks, unless price corrects further or migrating hash-power comes back online.

Top Tweets

It appears that Tom Brady’s newest profile picture may have been a reason for Bitcoin’s significant drop in the last month.

Luckily, Brady has become aware of this and has made the transition back to his normal state.

Peter Schiff will soon be worth less than his son, mark my words.

Video of the Week

Follow us on social media!

Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.