1/18/20 - 1/25/20

__________

Join us for our first meeting of the new year in the Avaya Auditorium (POB 2.302) on January 28th from 5-6pm! We will be hosting Josh Kerr from the Capital Factory to speak on entrepreneurship in blockchain.

___________

You might notice our new section on State of the Market this week, titled Bits of Bitcoin! In light of this new section, we’d like to offer the following disclaimer: Texas Blockchain’s ‘State of the Market’ is a student-led editorial. None of the views expressed by the authors should be taken as the view of the University of Texas at Austin or the Texas Blockchain organization. Furthermore, none of the views expressed should be taken as financial advice in any circumstance.

Fun Fact: This is the 33rd edition of State of the Market. We’ve been keeping you looped in since March 14, 2019!

___________

Asset | Price (USD) | 7 Day Change (%)

Bitcoin (BTC) | $8,376 | -5.93%

Ethereum (ETH) | $160.90 | -7.56%

Ripple (XRP) | $0.2211 | -9.05%

Bitcoin Cash (BCH) | $315.12 | -7.15%

Bitcoin SV (BSV) | $263.51 | +5.46%

Litecoin (LTC) | $53.53 | -9.61%

Data sourced from https://onchainfx.com at 12:00AM CST

Market Summary

It’s been a bit of a bearish week for the crypto markets, with Bitcoin and most altcoins experiencing a weeklong period of slow decline in the aftermath of last week’s incredible bull run. Bitcoin nearly broke $9,000 at the beginning this week, before slipping down to the mid $8,000s. With the halvening coming up quickly, currently estimated to occur on May 9th, it will be interesting to see how the market fluctuates in the upcoming months.

Top Stories

Bitcoin Develops in BIPs and Pieces

Bitcoin Improvement Proposals, or BIPs, are suggested changes in Bitcoin Core’s codebase submitted to the community’s open-source Github Repo. This is step-one for contributors to have their code and ideas committed in Bitcoin’s protocol layer. This past week, BIPs 340-342 were officially proposed to improve Bitcoin’s efficiency and privacy through implementing ‘Taproot’ and ‘Schnorr Signatures.’

Deloitte Approves Gemini Crypto Exchange in High-Level Security Evaluation

Founded by the Winklevoss twins, US crypto exchange Gemini is on a mission to lead cryptocurrency regulation. Its marketing campaign last year ran street ads donning “Crypto Needs Rules”. The exchange is subject to audits by the New York State Department of Financial Services (NYSDFS). Last week, Gemini passed a SOC 2 Type 2 evaluation conducted by Deloitte. This demonstrates a higher level of compliance than any other crypto exchange and custodian in the US.

Cryptocurrency Hackers Were More Active in 2019, but Were Less Successful

According to a recent cryptocurrency crime analysis by Chainalysis, it has been found that while 2019 had hosted the most major cryptocurrency hacks of any previous years, the total amount of money stolen was almost halved from 2018. According to the report, “with no hacks taking in more than the $105 million stolen from Coinbene, both the average and median amount stolen per hack fell substantially in 2019, after having risen each of the three preceding years.”

Bits of Bitcoin

Has anyone you respect ever told you that bitcoin doesn’t make any sense? Maybe you’ve heard that it’s not backed by anything, it’s too volatile, or it’s only useful to criminals; cryptocurrencies are always explained as either “too this” or “too that,” right? Maybe a crypto advocate has told you ethereum is the token of the future, that Facebook’s Libra will be the world’s dominant digital currency, or that bitcoin cash is the real bitcoin. Perhaps you are the skeptic that doesn’t believe in bitcoin, understand how it works, or more importantly, why bitcoin matters.

For the next 16 weeks, this column aims to debunk common misconceptions related to bitcoin, explain important characteristics of bitcoin, the asset, and Bitcoin, the network, and ultimately conclude -- why does bitcoin matter?

If you’d like to see your questions or criticisms about bitcoin answered in this column, please fill out this form.

Chart of the Week

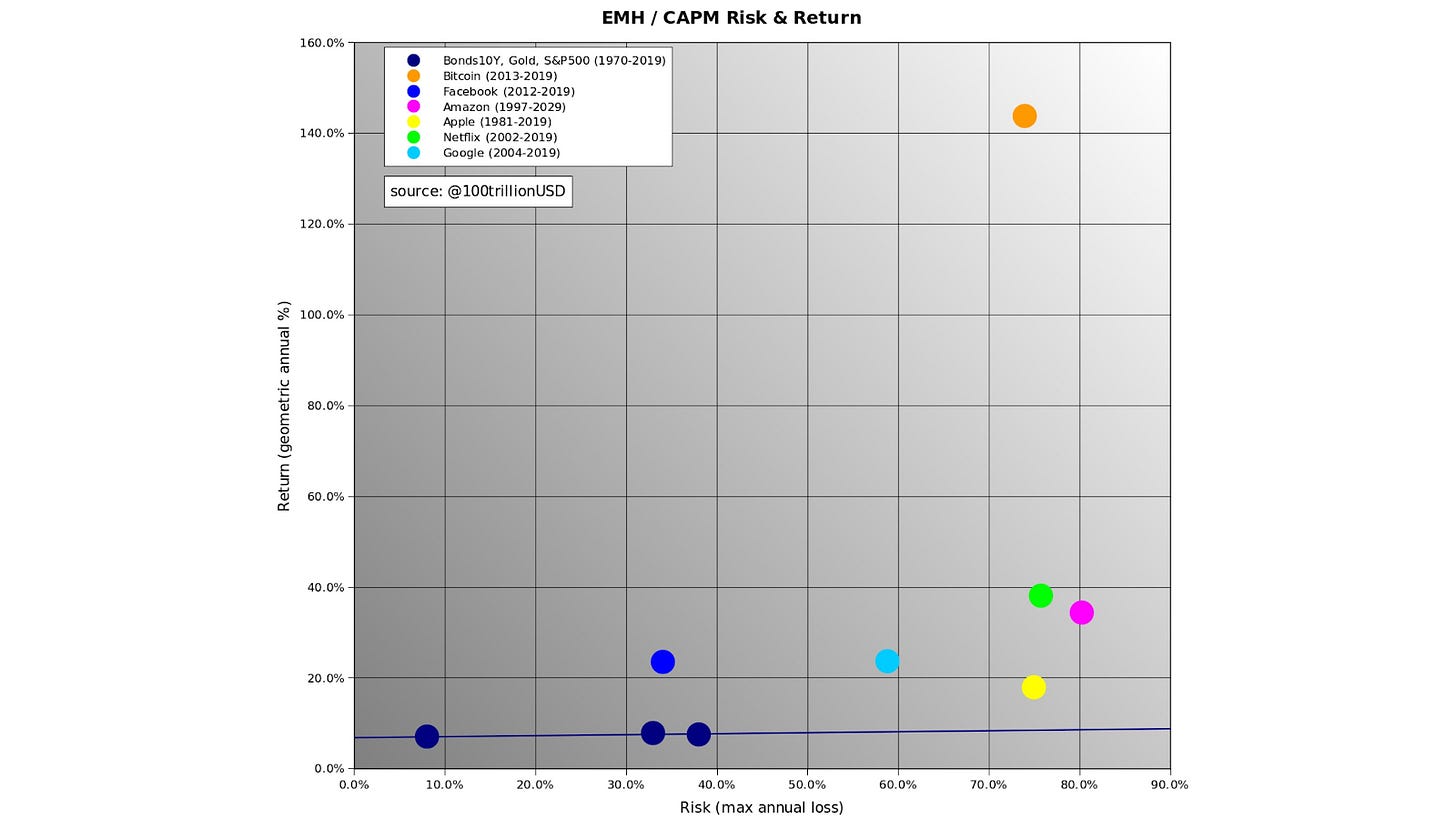

PlanB, @100TrillionUSD, published his second article on Medium, titled “Efficient Market Hypothesis and Bitcoin Stock-to-Flow Model”. The anonymous statistician caused quite a stir after his first article showing Bitcoin’s scarcity as the source of its market value.

Tweet of the Week

@celiawan2 outlines the crypto custody space. Who will people trust with their keys?

@Crypto_Bitlord is trapped in China documenting the spread of the Coronavirus. His profile is pure gold right now.

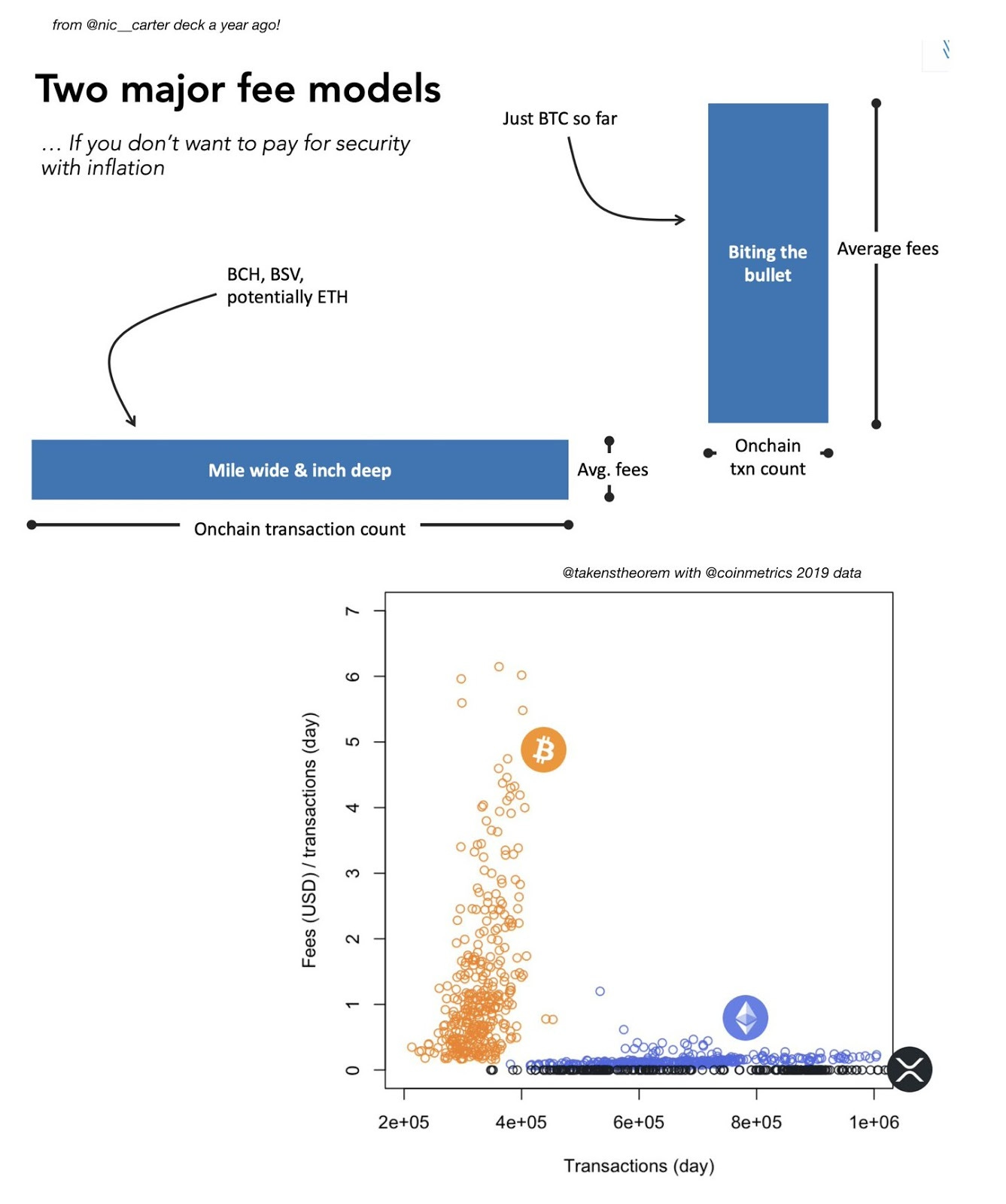

@takenstheorem creates a chart supporting @nic__carter’s idea on the fee-based models that cryptocurrencies can use to support miners without inflating the token supply. The “Mile Wide & Inch Deep” approach prefers adjustable block sizes (low fees, high volume), while the “Bite the Bullet” approach prefers a fixed block size (high fees, low volume). FYI Coin Metrics has sick data.

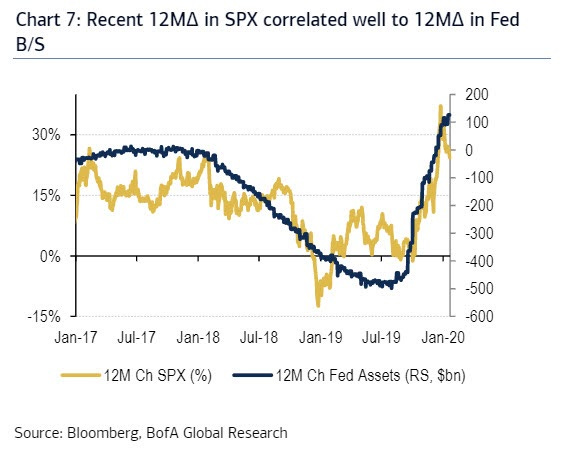

@QTRResearch mocks the extraordinary all-time-highs of the US stock market, blaming the Federal Reserve’s money printing machine.

Related. S&P 500 vs. Fed Balance Sheet. From Bloomberg and Bank of America.

@mikeinspace questions the ability of Bitcoin’s “store of value” use case to dominate in the future. He highlights that most users of Bitcoin are first-world investors with no need for censorship resistance.

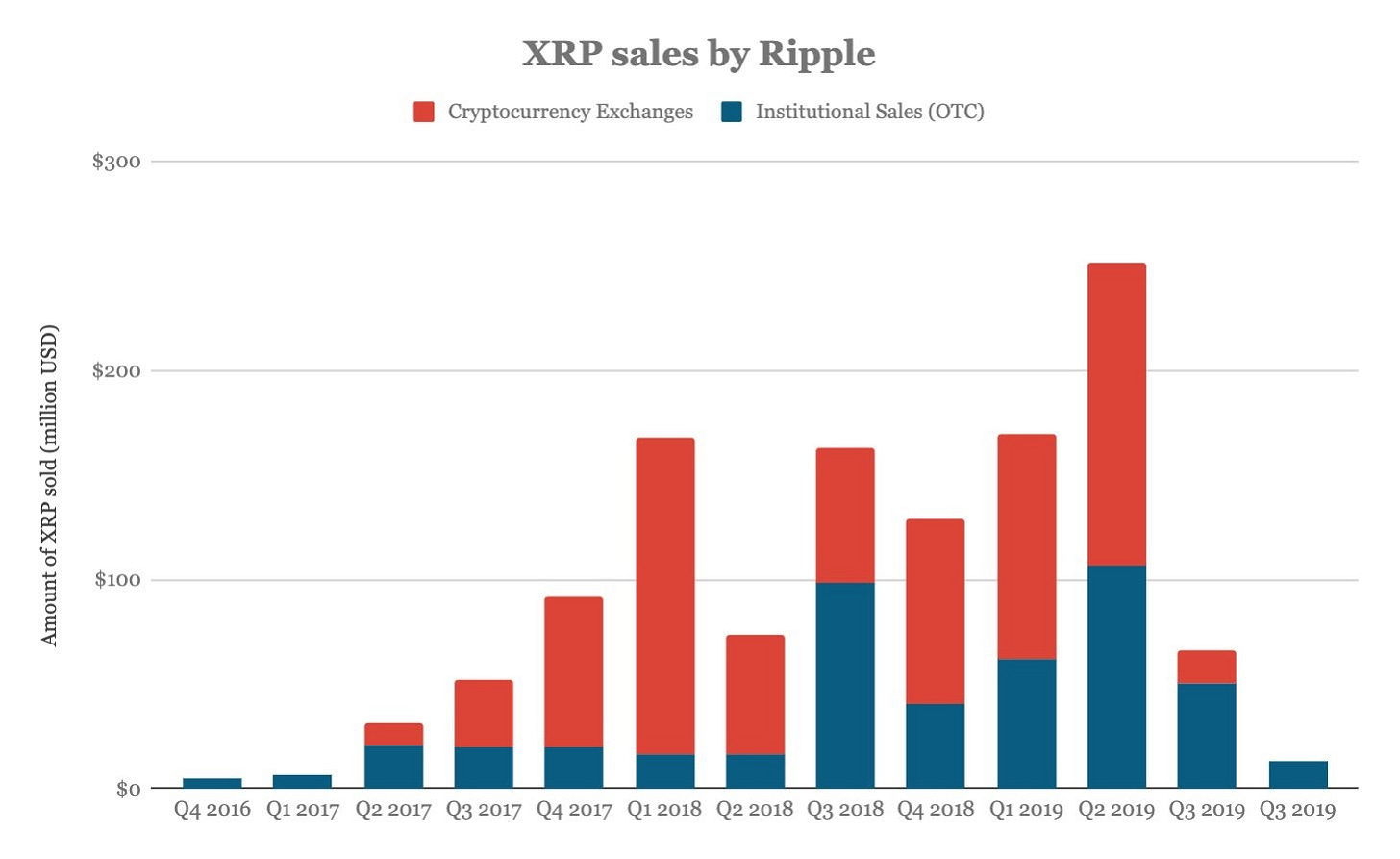

@lawmaster observed that Ripple only sold $13M worth of XRP in Q4 of 2019, its lowest quarterly sales in three years. This comes after Ripple’s recent $200M funding round.

Do you think Bitcoin is going to $250K? According to @MustStopMurad’s meme, you’re either dumb as a rock or god-level genius.

After you’re last class of the day.

Video of the Week

Free-Market Environmentalism: How to save the planet without destroying the world.